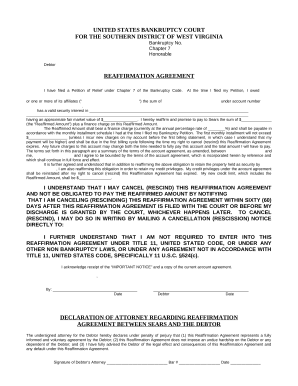

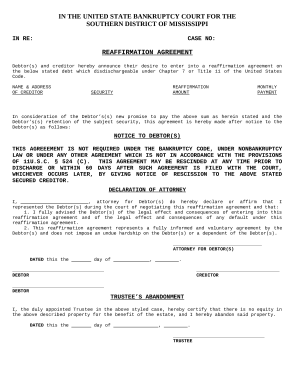

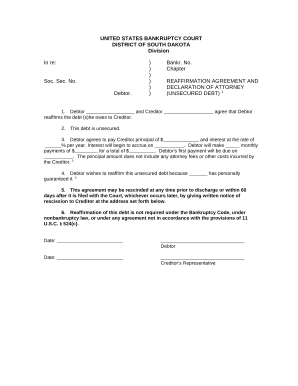

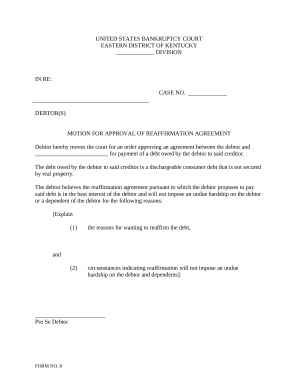

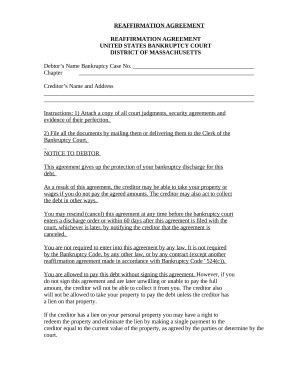

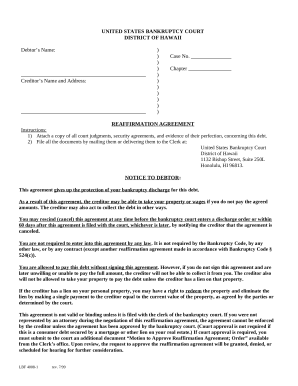

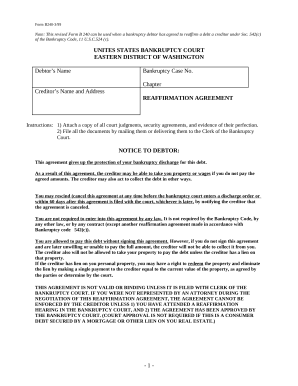

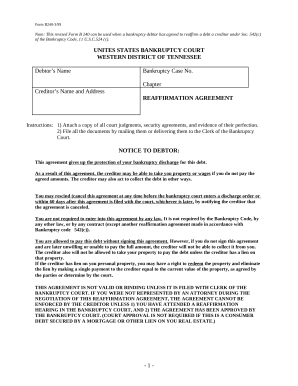

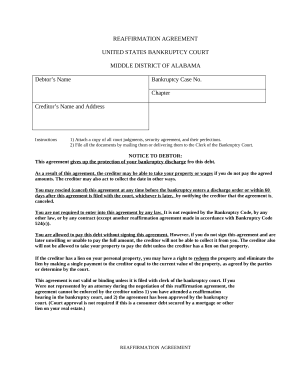

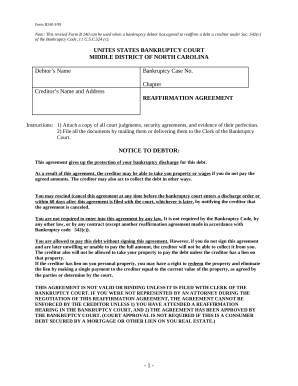

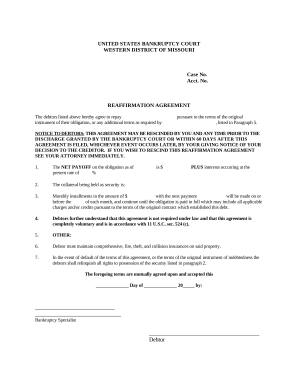

Speed up your document management using our Reaffirmation Agreement Forms online library with ready-made document templates that suit your needs. Access your document, modify it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your documents.

The best way to manage our Reaffirmation Agreement Forms:

Examine all the opportunities for your online document management using our Reaffirmation Agreement Forms. Get a totally free DocHub profile right now!