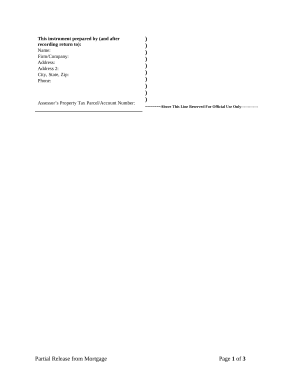

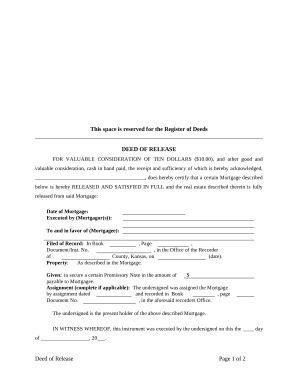

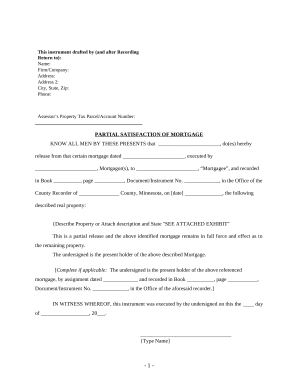

Your workflows always benefit when you can discover all of the forms and files you need at your fingertips. DocHub delivers a wide array of templates to alleviate your daily pains. Get a hold of Property Lien Release category and quickly browse for your form.

Start working with Property Lien Release in a few clicks:

Enjoy effortless file administration with DocHub. Explore our Property Lien Release collection and look for your form today!