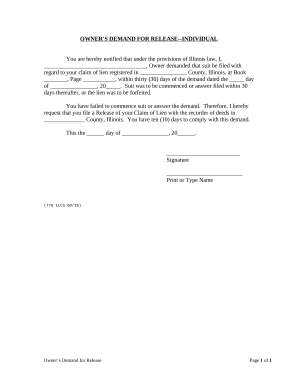

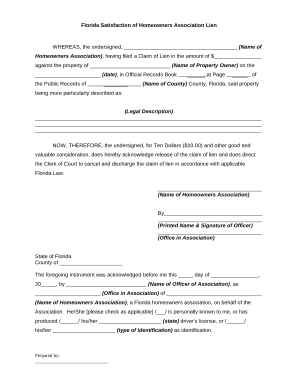

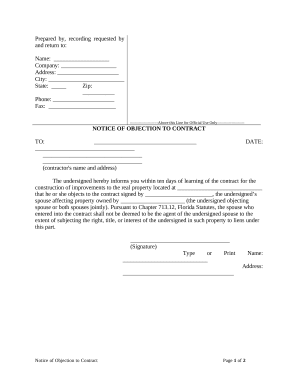

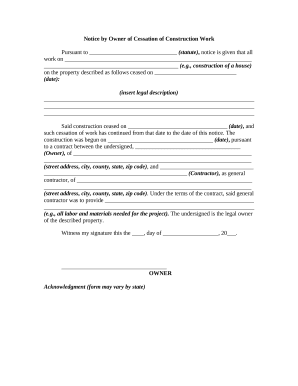

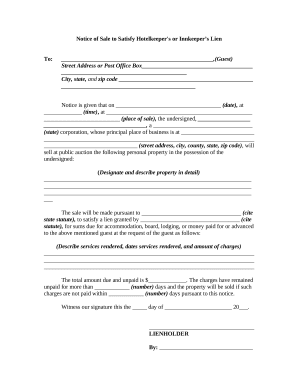

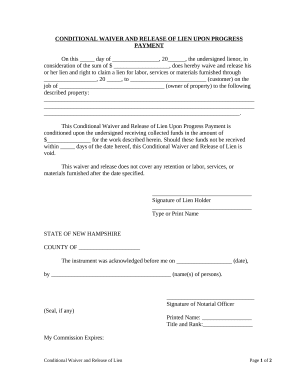

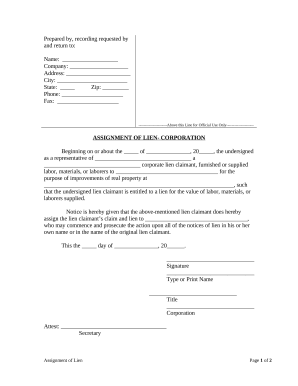

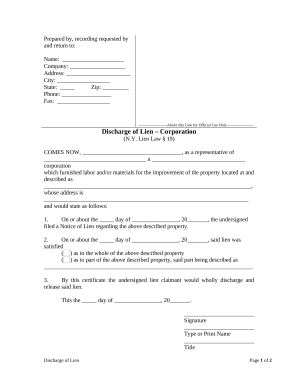

Accelerate your file operations using our Property Lien Documents library with ready-made form templates that suit your needs. Get the document, alter it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your documents.

The best way to use our Property Lien Documents:

Examine all the possibilities for your online file administration with the Property Lien Documents. Get your free free DocHub profile today!