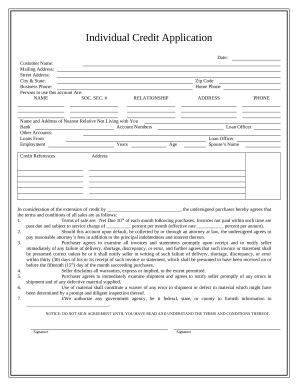

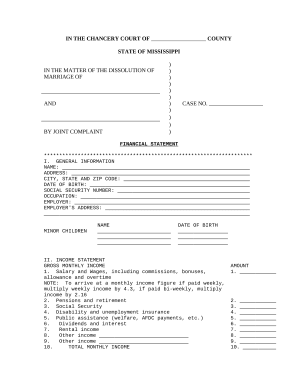

Your workflows always benefit when you are able to find all the forms and documents you will need on hand. DocHub provides a huge selection of document templates to relieve your everyday pains. Get a hold of Personal Finance Management category and easily discover your form.

Begin working with Personal Finance Management in several clicks:

Enjoy effortless document managing with DocHub. Check out our Personal Finance Management category and get your form today!