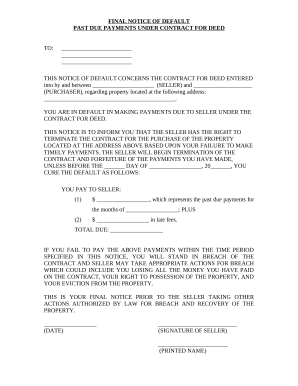

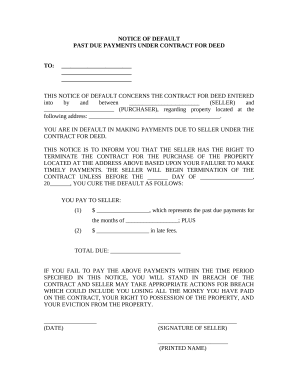

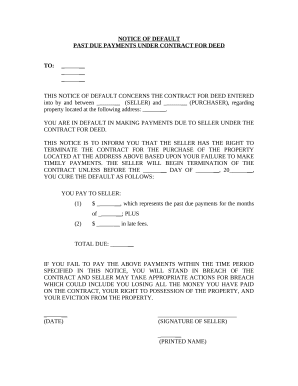

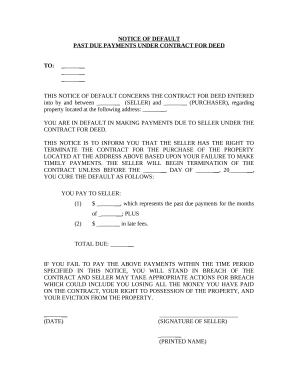

Your workflows always benefit when you are able to get all of the forms and files you require at your fingertips. DocHub offers a a huge collection of document templates to alleviate your day-to-day pains. Get hold of Payment Default Forms category and quickly find your document.

Begin working with Payment Default Forms in several clicks:

Enjoy smooth document management with DocHub. Discover our Payment Default Forms category and locate your form today!