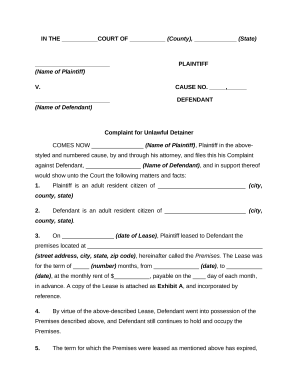

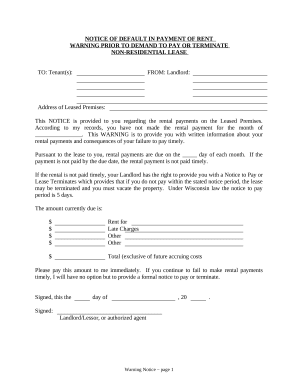

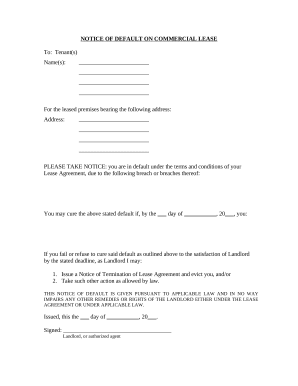

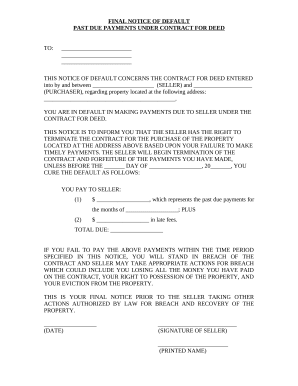

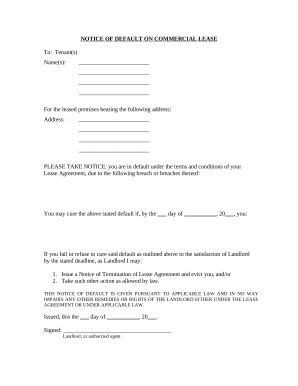

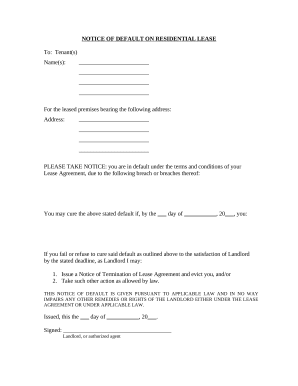

Transform your document management with Notice of Default

Your workflows always benefit when you can obtain all the forms and files you need on hand. DocHub delivers a a huge library of forms to relieve your day-to-day pains. Get hold of Notice of Default category and quickly find your document.

Begin working with Notice of Default in several clicks:

- Access Notice of Default and get the document you require.

- Click Get Form to open it in the editor.

- Begin adjusting your file: add more fillable fields, highlight paragraphs, or blackout sensitive information.

- The application saves your modifications automatically, and after you are ready, you can download or distribute your form with other contributors.

Enjoy easy record managing with DocHub. Check out our Notice of Default category and locate your form right now!