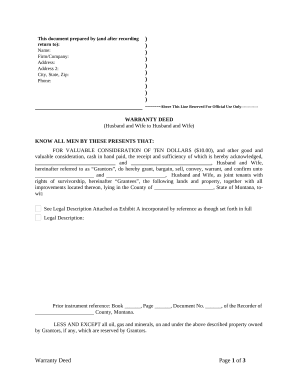

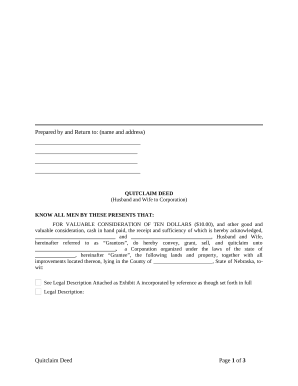

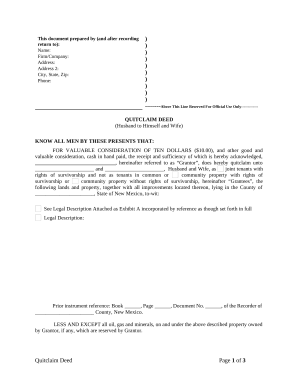

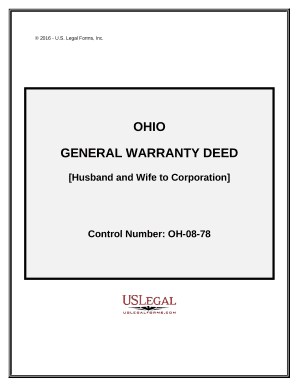

Improve your document operations with our Marital Property Deed Transfer library with ready-made templates that meet your needs. Access the form, edit it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

The best way to manage our Marital Property Deed Transfer:

Examine all the possibilities for your online document administration with our Marital Property Deed Transfer. Get a totally free DocHub account right now!