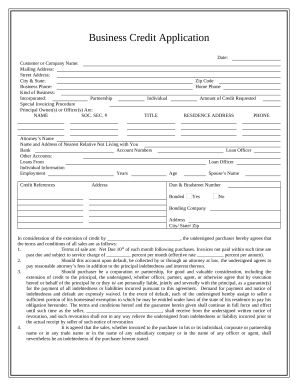

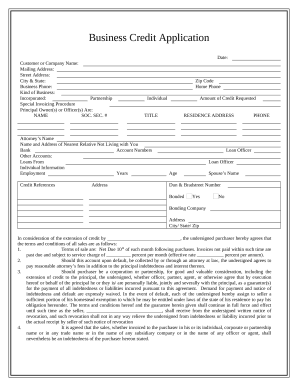

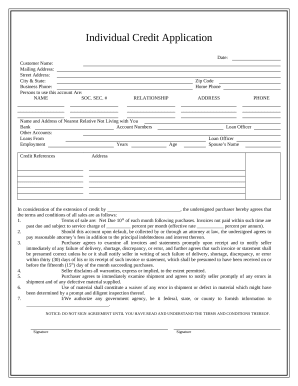

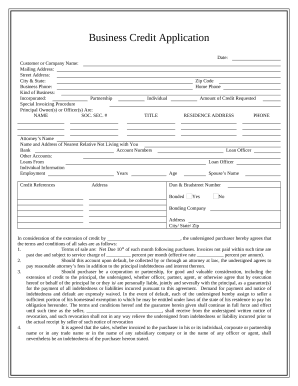

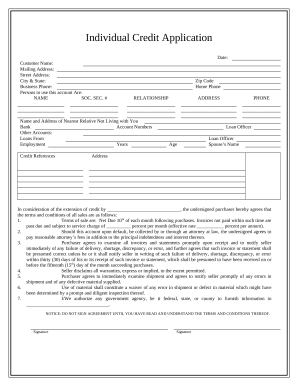

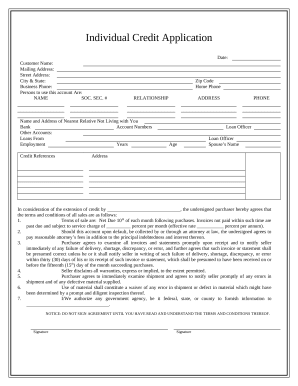

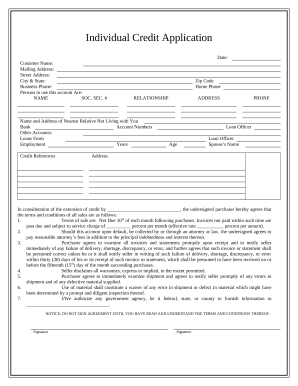

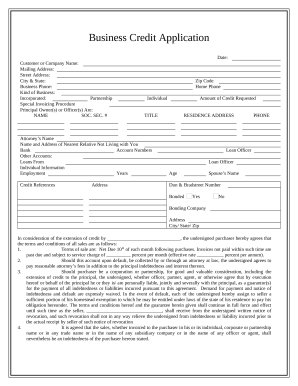

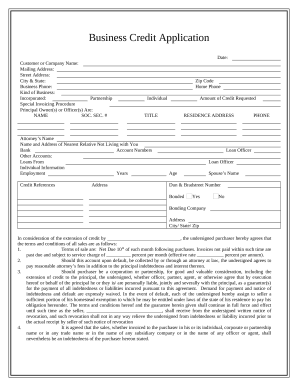

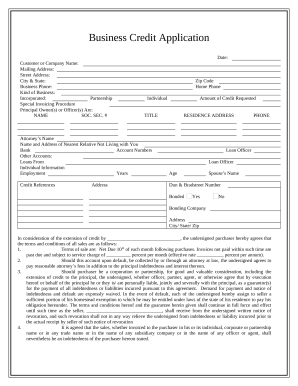

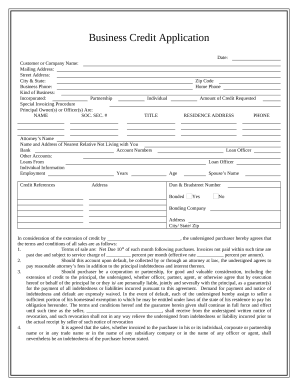

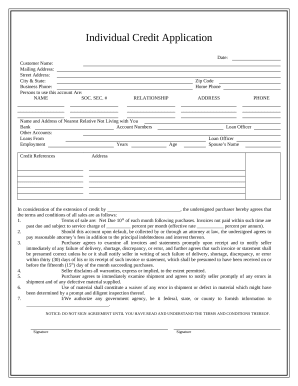

Boost your file administration with our Loan Applications collection with ready-made document templates that suit your requirements. Access the document, change it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently together with your documents.

How to use our Loan Applications:

Examine all of the opportunities for your online document administration with our Loan Applications. Get a free free DocHub account today!