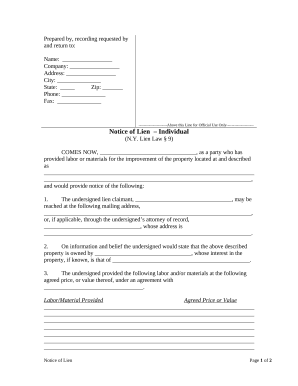

Your workflows always benefit when you can easily locate all of the forms and files you require on hand. DocHub offers a wide array of templates to relieve your daily pains. Get hold of Lien Notice Forms category and easily discover your form.

Begin working with Lien Notice Forms in a few clicks:

Enjoy fast and easy file managing with DocHub. Discover our Lien Notice Forms category and get your form right now!