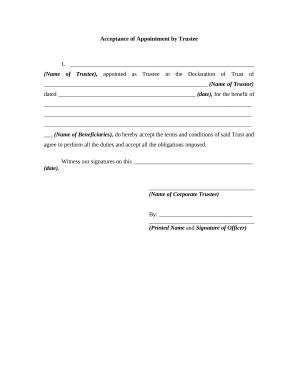

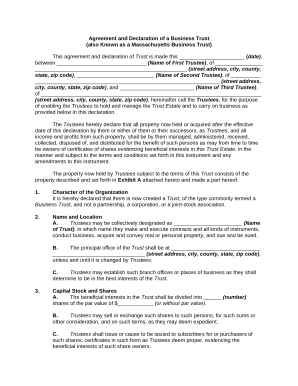

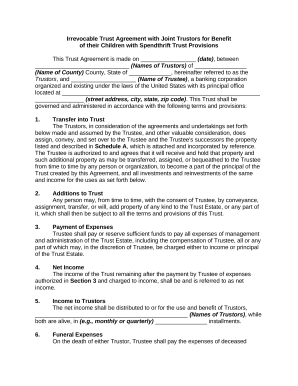

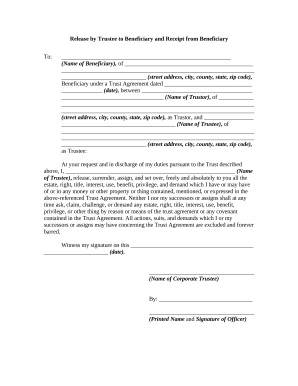

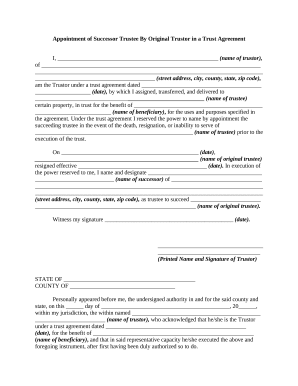

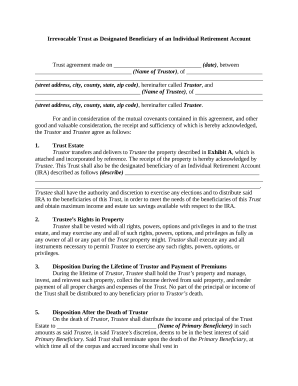

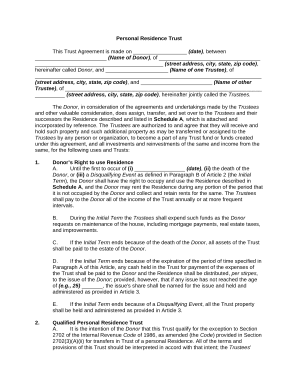

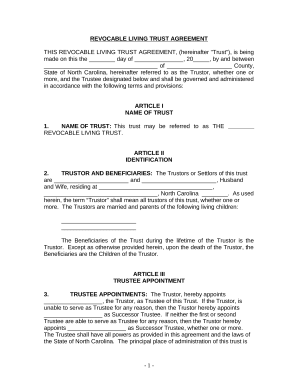

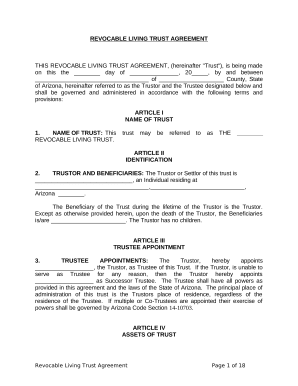

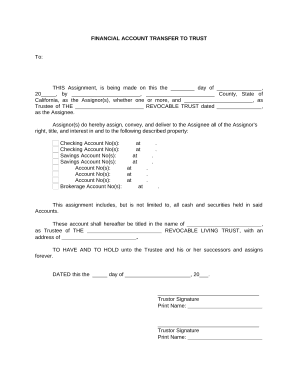

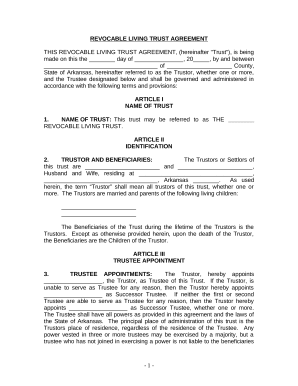

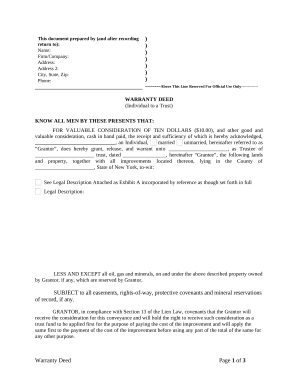

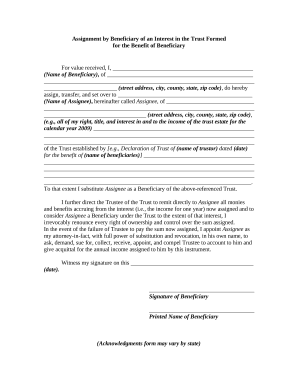

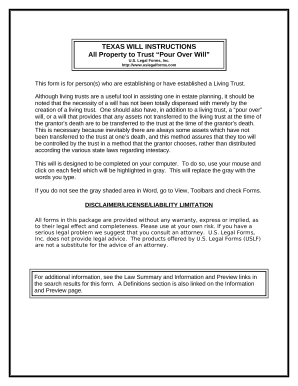

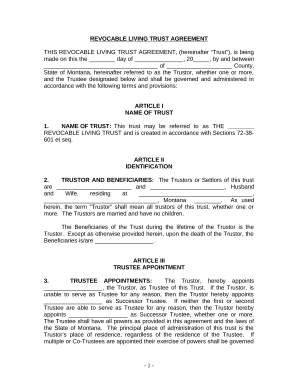

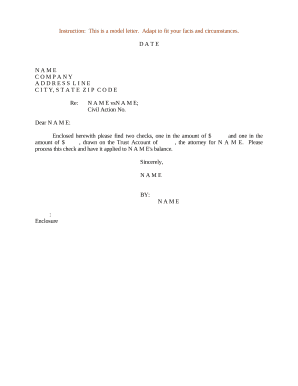

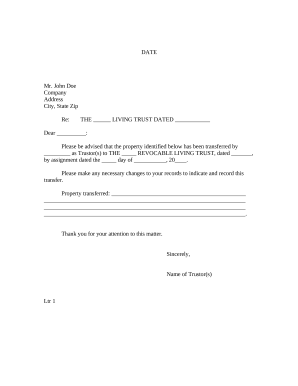

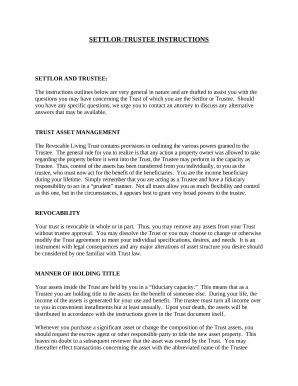

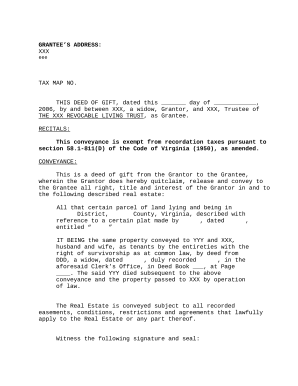

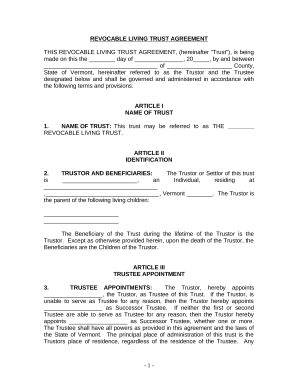

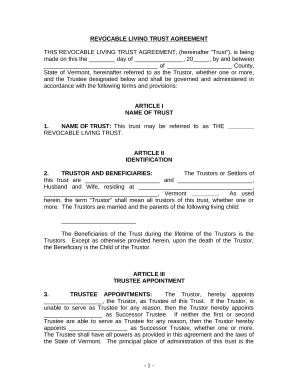

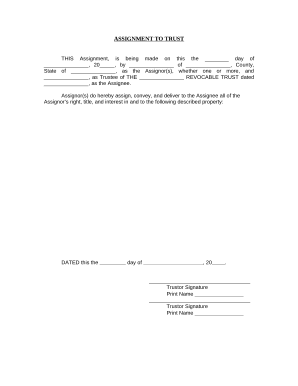

Improve your form administration with our Legal Forms for Trusts collection with ready-made form templates that suit your needs. Get your form, alter it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with your documents.

The best way to use our Legal Forms for Trusts:

Examine all of the opportunities for your online document administration with our Legal Forms for Trusts. Get your free free DocHub profile today!