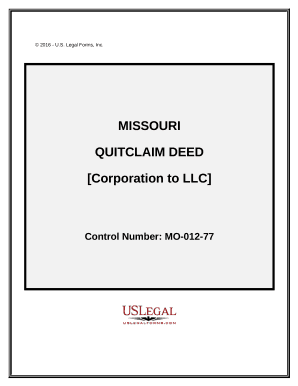

Your workflows always benefit when you can locate all the forms and files you may need on hand. DocHub provides a a huge collection of forms to alleviate your day-to-day pains. Get hold of Legal Corporate Forms category and quickly find your document.

Begin working with Legal Corporate Forms in a few clicks:

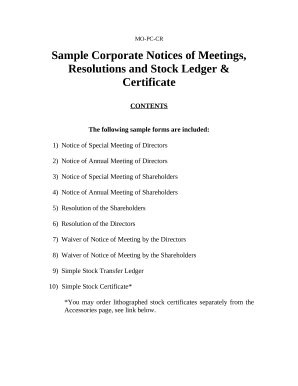

Enjoy easy file management with DocHub. Discover our Legal Corporate Forms online library and discover your form today!