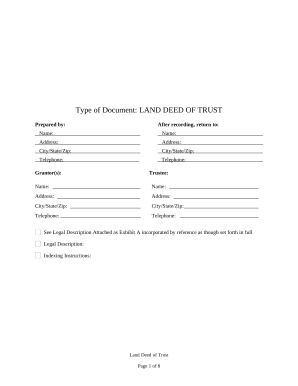

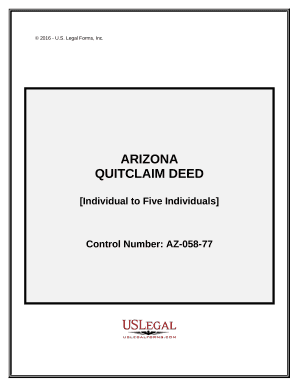

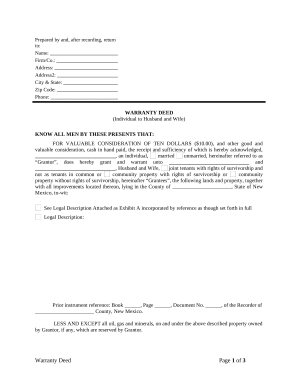

Improve your file management with our Land Ownership Transfer Deeds online library with ready-made document templates that meet your requirements. Get the form template, edit it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your documents.

How to use our Land Ownership Transfer Deeds:

Discover all the opportunities for your online document management with the Land Ownership Transfer Deeds. Get your free free DocHub account today!