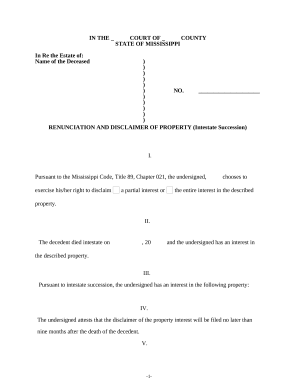

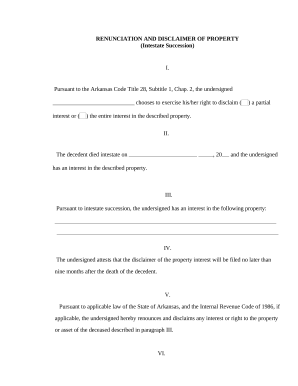

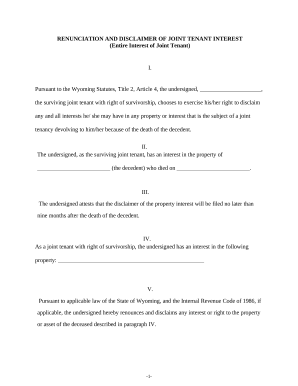

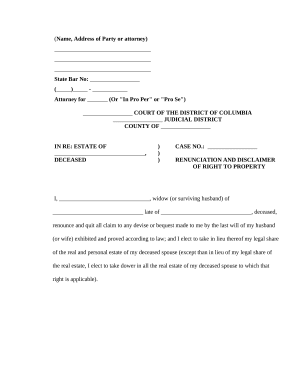

Boost your document administration with our Inheritance Disclaimer Forms collection with ready-made form templates that suit your needs. Access the document, alter it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the forms.

The best way to use our Inheritance Disclaimer Forms:

Examine all the possibilities for your online document administration with our Inheritance Disclaimer Forms. Get your totally free DocHub account right now!