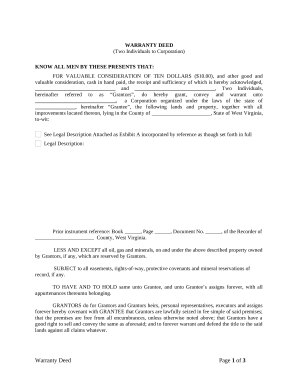

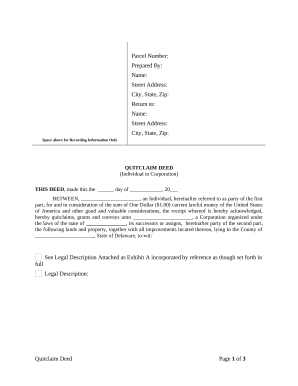

Boost your file managing with the Individual to Corporation Deed Transfers category with ready-made templates that meet your needs. Access the document, edit it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively with the documents.

The best way to use our Individual to Corporation Deed Transfers:

Discover all the opportunities for your online document administration with our Individual to Corporation Deed Transfers. Get a free free DocHub account today!