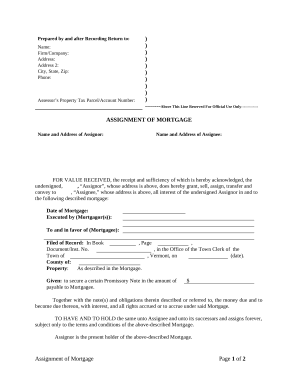

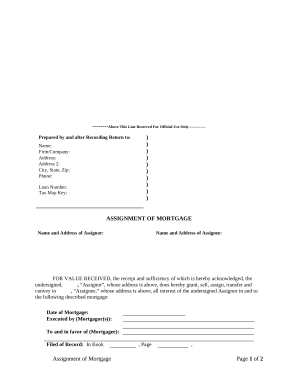

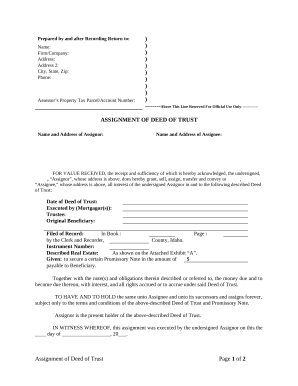

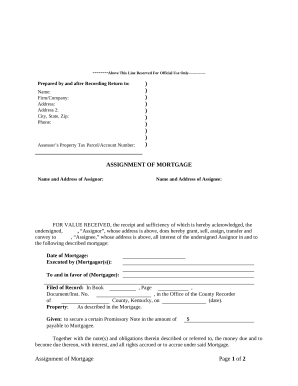

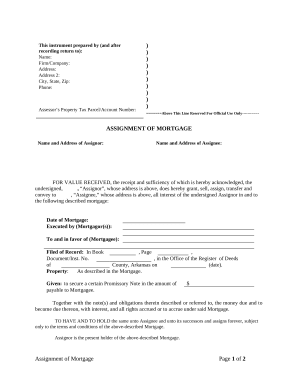

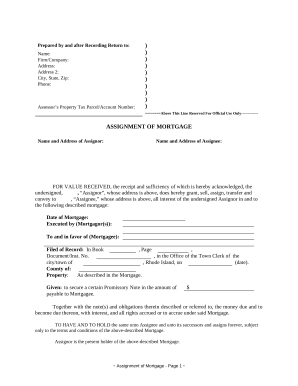

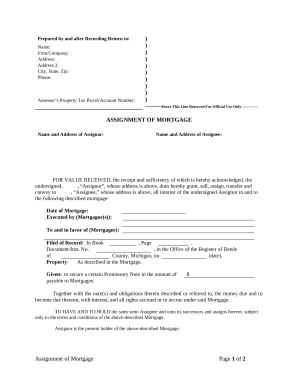

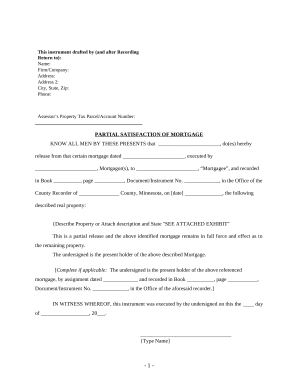

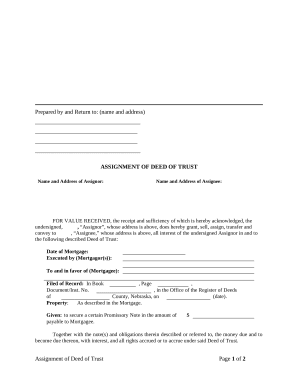

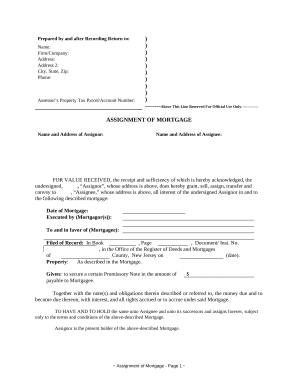

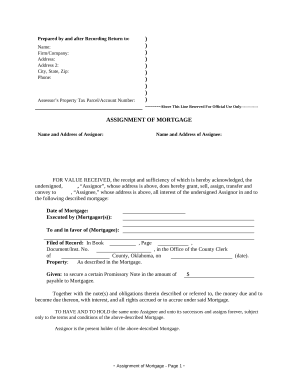

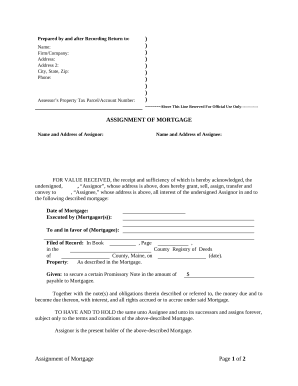

Accelerate your document administration with our Individual Mortgage Holder Documents online library with ready-made form templates that suit your requirements. Access the form template, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your forms.

The best way to manage our Individual Mortgage Holder Documents:

Discover all of the opportunities for your online document management with the Individual Mortgage Holder Documents. Get a totally free DocHub account right now!