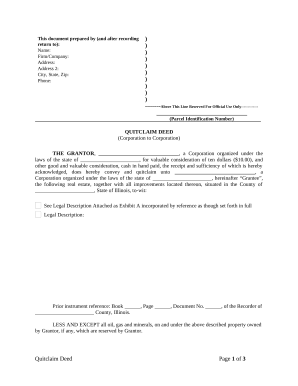

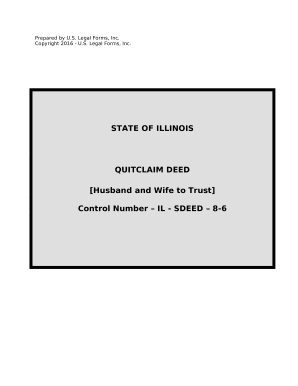

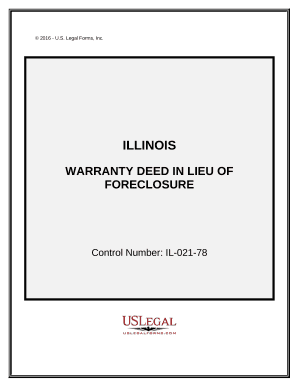

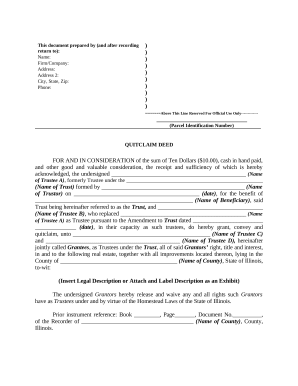

Accelerate your document management with our Illinois Property Transfer Forms category with ready-made document templates that meet your needs. Access your form, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively with your documents.

How to use our Illinois Property Transfer Forms:

Explore all of the opportunities for your online document management with our Illinois Property Transfer Forms. Get a free free DocHub profile today!