Start by logging into your DocHub account. Try out the pro DocHub functionality free for 30 days.

Once logged in, go to the DocHub dashboard. This is where you'll create your forms and manage your document workflow.

Hit New Document and choose Create Blank Document to be taken to the form builder.

Use the DocHub features to insert and arrange form fields like text areas, signature boxes, images, and others to your form.

Include needed text, such as questions or instructions, using the text tool to lead the users in your form.

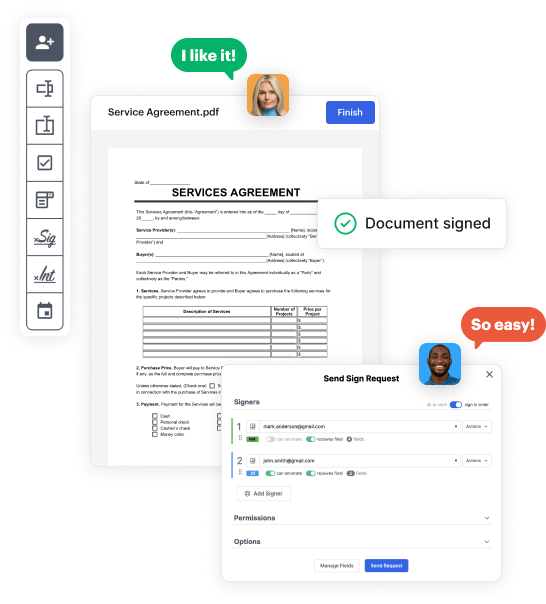

Alter the properties of each field, such as making them mandatory or arranging them according to the data you expect to collect. Assign recipients if applicable.

After you’ve managed to design the Guarantor Lease Form, make a final review of your form. Then, save the form within DocHub, transfer it to your chosen location, or distribute it via a link or email.