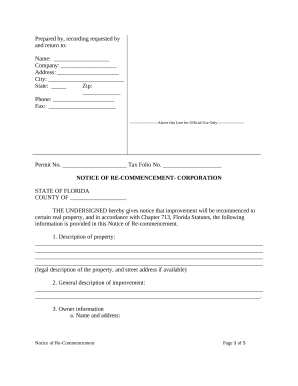

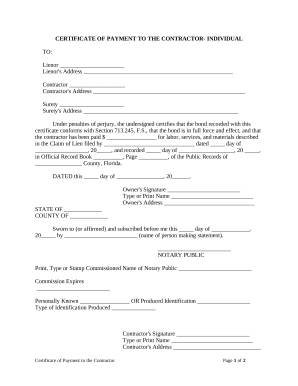

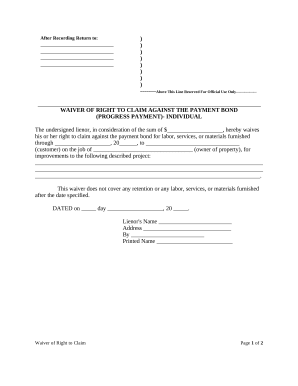

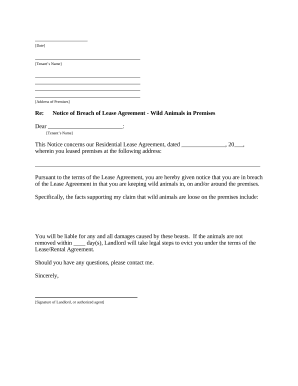

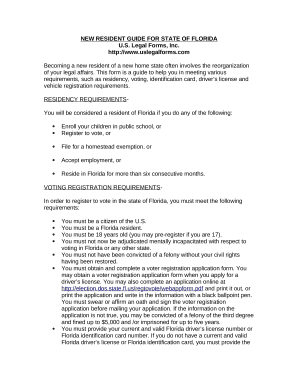

Document administration takes up to half of your business hours. With DocHub, you can easily reclaim your time and increase your team's efficiency. Get Florida State Forms collection and check out all document templates relevant to your day-to-day workflows.

The best way to use Florida State Forms:

Improve your day-to-day file administration with our Florida State Forms. Get your free DocHub account right now to discover all forms.