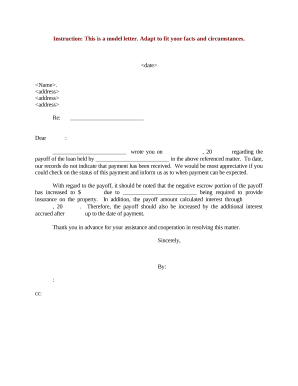

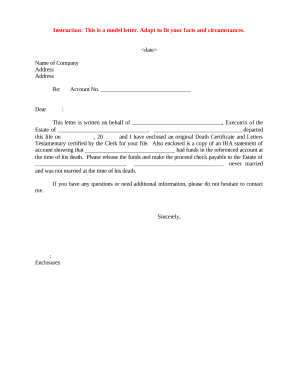

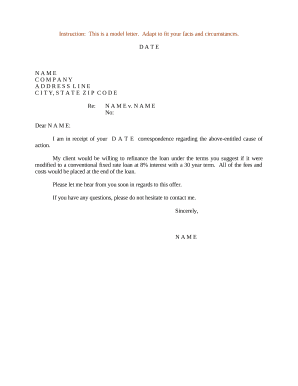

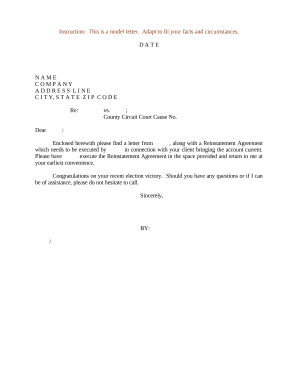

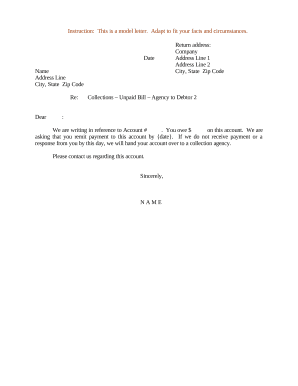

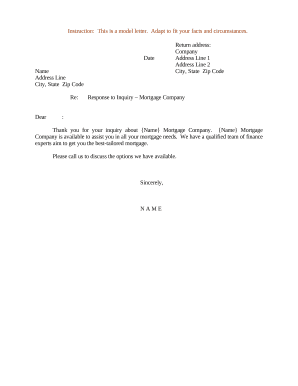

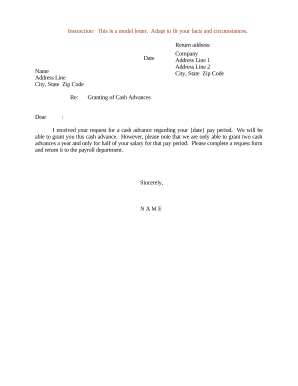

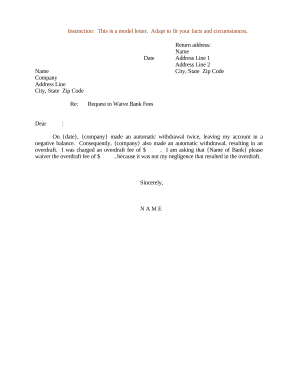

Accelerate your file managing using our Financial Letters collection with ready-made templates that meet your requirements. Access your document template, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently together with your documents.

The best way to use our Financial Letters:

Discover all of the possibilities for your online document administration with our Financial Letters. Get a totally free DocHub profile right now!