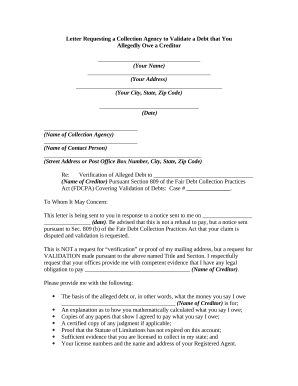

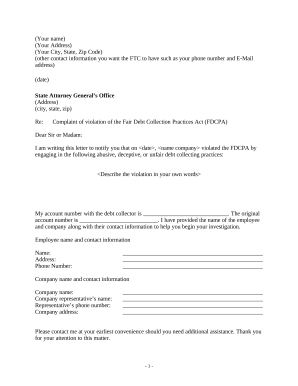

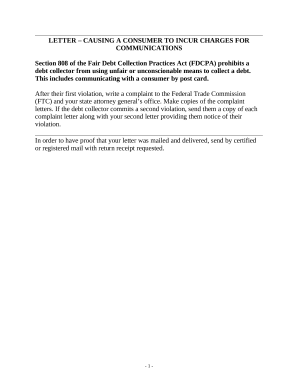

Your workflows always benefit when you can locate all of the forms and documents you will need at your fingertips. DocHub provides a wide array of templates to ease your daily pains. Get a hold of Fair Debt Practices Act Forms category and quickly find your form.

Start working with Fair Debt Practices Act Forms in several clicks:

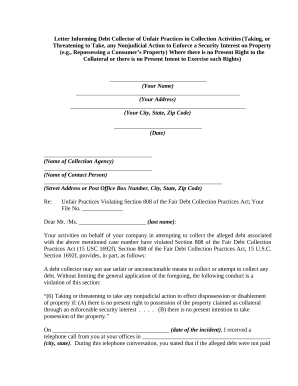

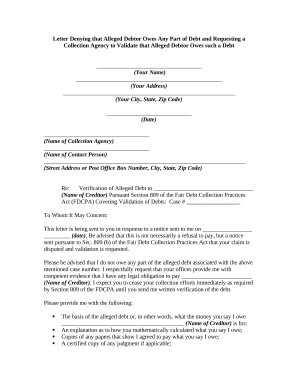

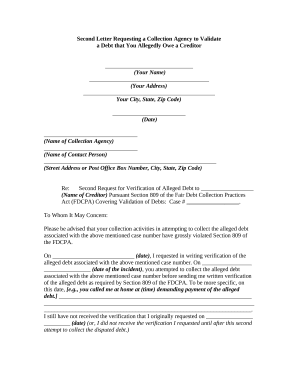

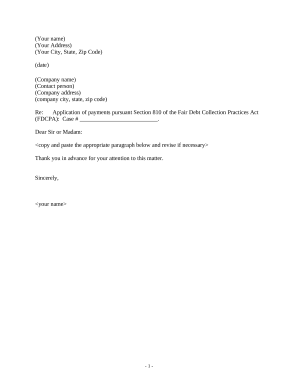

Enjoy seamless file managing with DocHub. Discover our Fair Debt Practices Act Forms collection and get your form today!