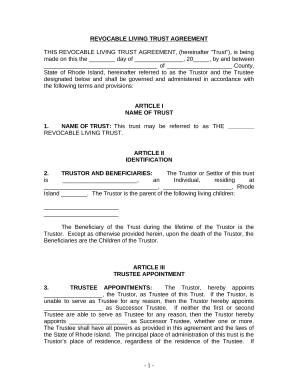

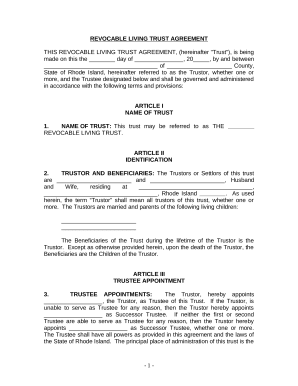

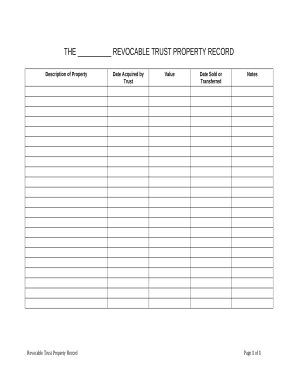

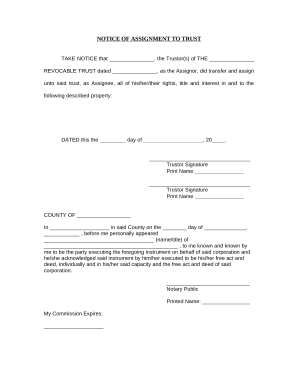

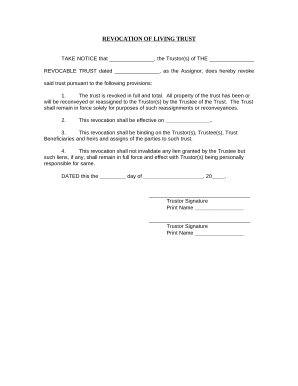

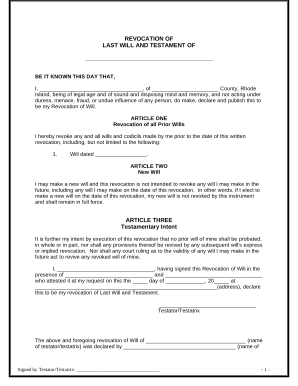

Speed up your form administration with the Estate Planning in Rhode Island library with ready-made form templates that meet your requirements. Get the form, alter it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently with the forms.

How to use our Estate Planning in Rhode Island:

Examine all of the opportunities for your online document administration with the Estate Planning in Rhode Island. Get your totally free DocHub account right now!