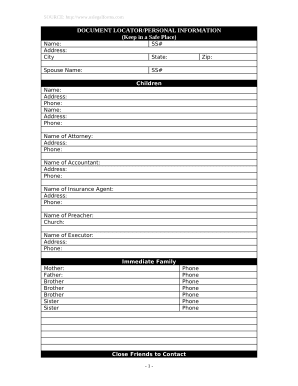

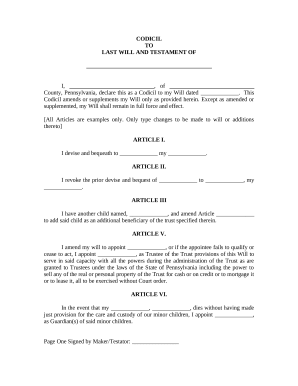

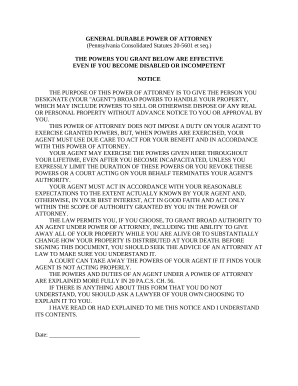

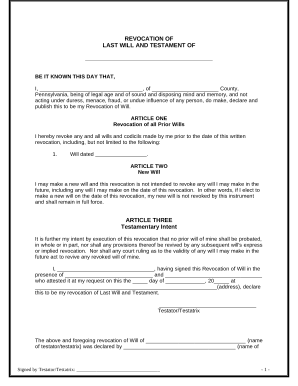

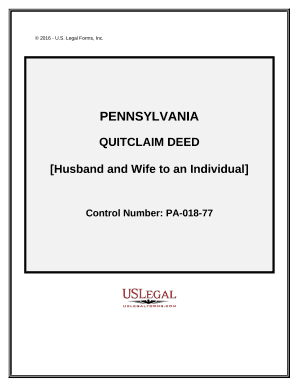

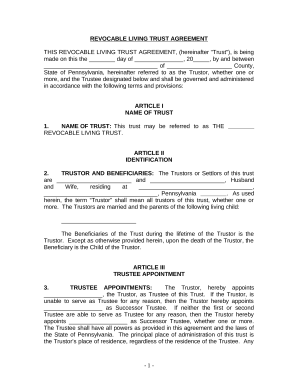

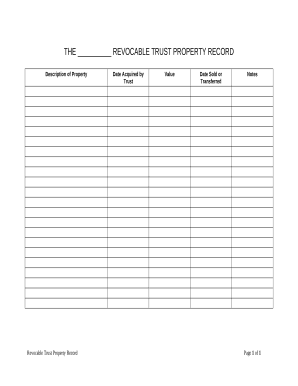

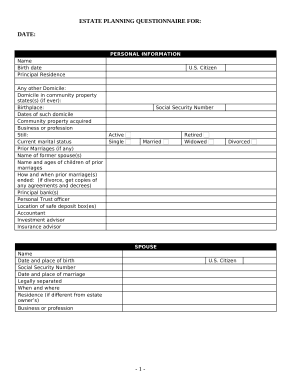

Boost your document administration with the Estate Planning in Pennsylvania category with ready-made form templates that meet your requirements. Access the document template, edit it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively with your documents.

The best way to manage our Estate Planning in Pennsylvania:

Examine all of the possibilities for your online file management with the Estate Planning in Pennsylvania. Get a free free DocHub profile right now!