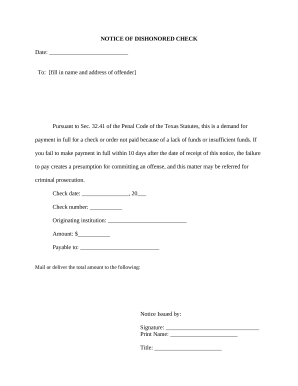

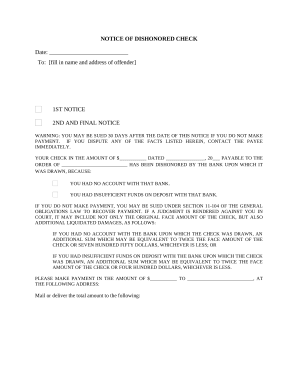

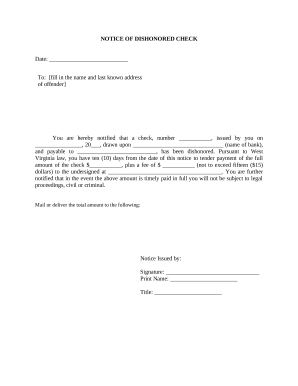

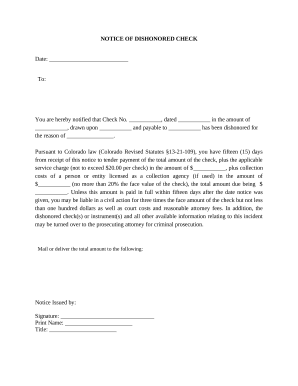

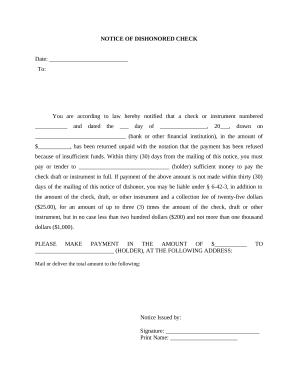

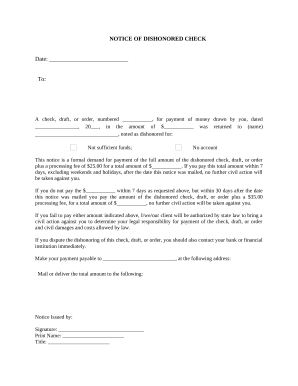

Your workflows always benefit when you can find all the forms and documents you need on hand. DocHub provides a huge selection of templates to ease your day-to-day pains. Get hold of Dishonored Checks Forms category and easily discover your form.

Start working with Dishonored Checks Forms in a few clicks:

Enjoy smooth form management with DocHub. Check out our Dishonored Checks Forms category and look for your form today!