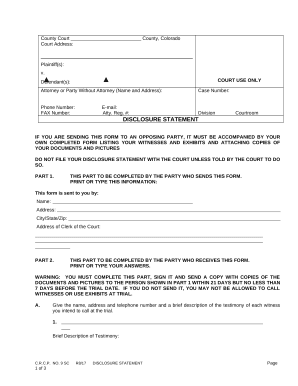

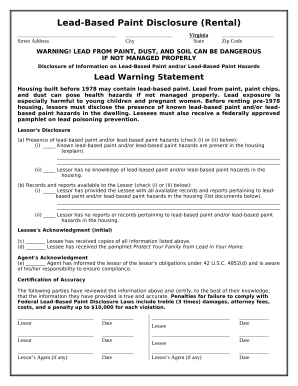

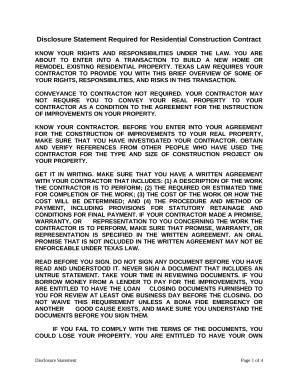

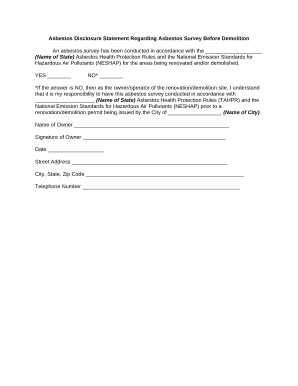

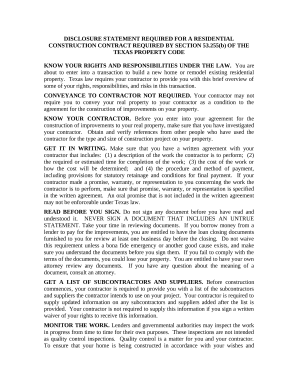

Your workflows always benefit when you can discover all of the forms and documents you will need at your fingertips. DocHub delivers a vast array of documents to relieve your day-to-day pains. Get a hold of Disclosure Statement Forms category and easily discover your form.

Start working with Disclosure Statement Forms in a few clicks:

Enjoy fast and easy form managing with DocHub. Discover our Disclosure Statement Forms online library and find your form right now!