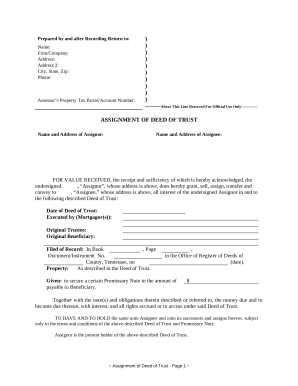

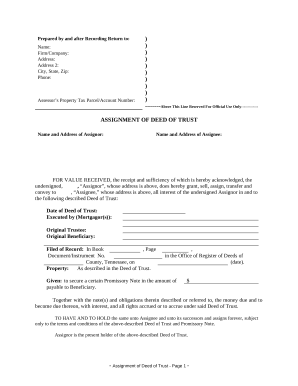

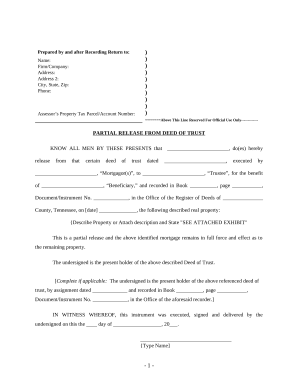

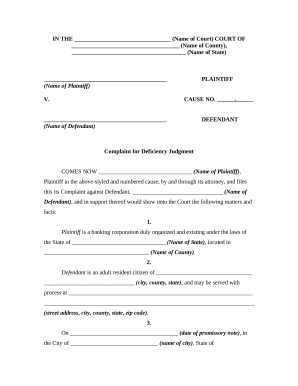

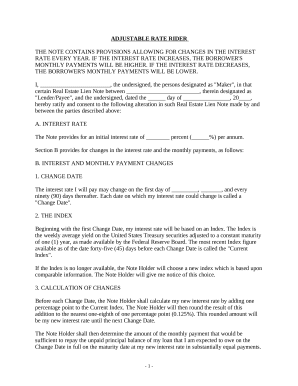

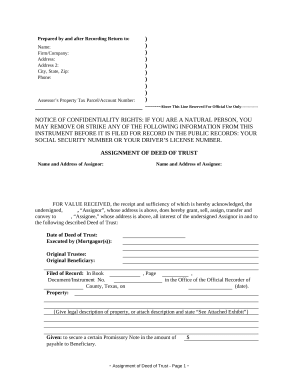

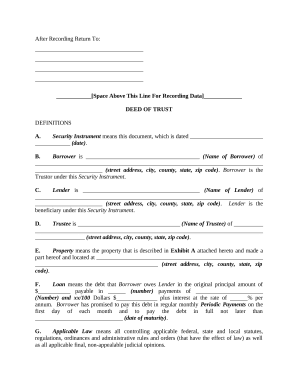

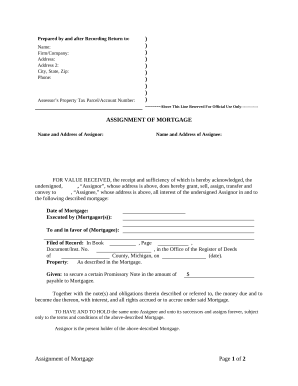

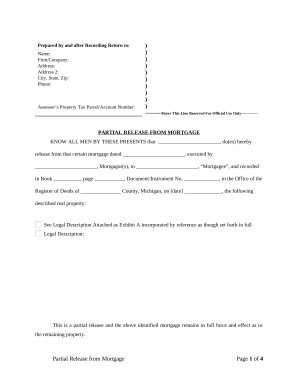

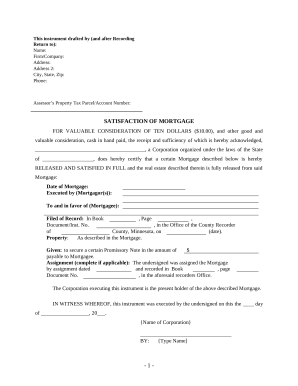

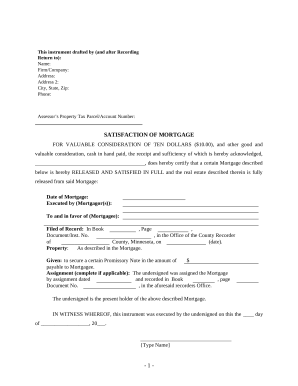

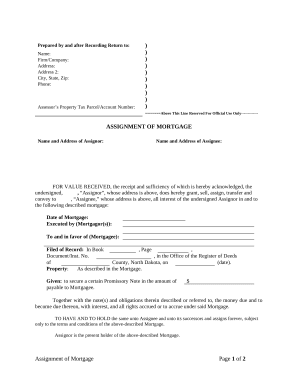

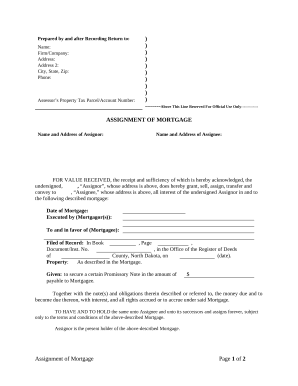

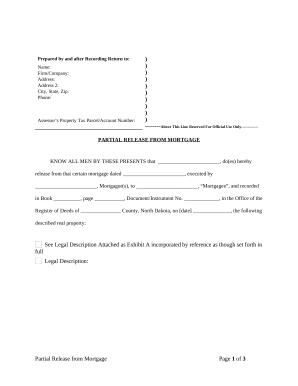

Accelerate your file managing using our Deeds of Trust Forms collection with ready-made templates that meet your needs. Access the document template, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your forms.

The best way to manage our Deeds of Trust Forms:

Examine all of the opportunities for your online document management using our Deeds of Trust Forms. Get a totally free DocHub account today!