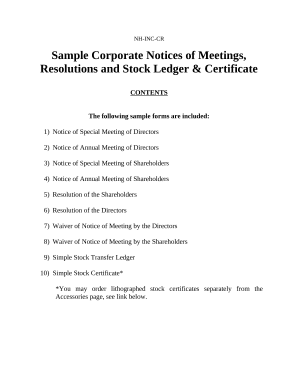

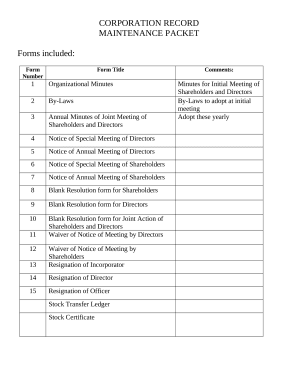

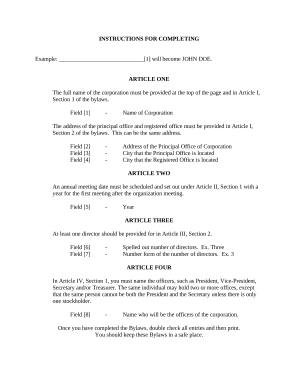

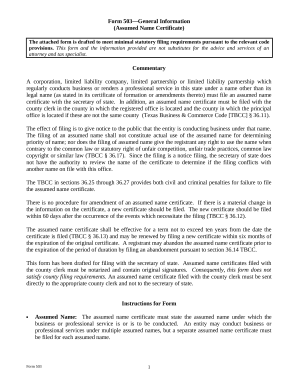

Boost your file operations with our Corporations Legal Forms collection with ready-made form templates that meet your requirements. Access the document template, change it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with the documents.

The best way to use our Corporations Legal Forms:

Discover all of the possibilities for your online document management with our Corporations Legal Forms. Get a totally free DocHub profile today!