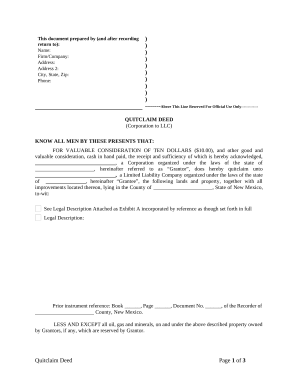

Your workflows always benefit when you can easily find all of the forms and documents you need on hand. DocHub delivers a a huge collection of form templates to relieve your everyday pains. Get a hold of Corporation Real Estate Transactions category and easily discover your document.

Begin working with Corporation Real Estate Transactions in a few clicks:

Enjoy fast and easy form management with DocHub. Discover our Corporation Real Estate Transactions collection and discover your form right now!