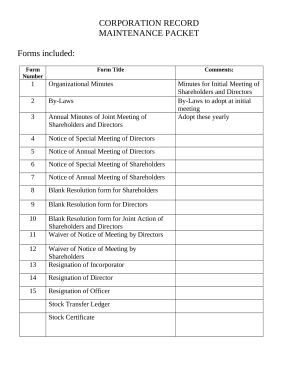

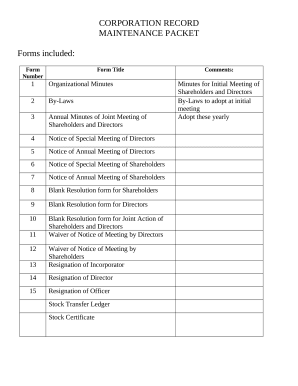

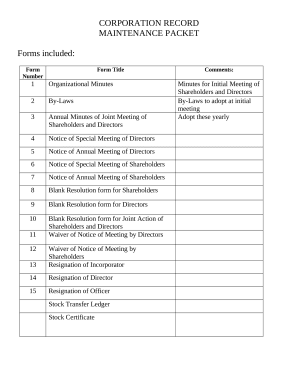

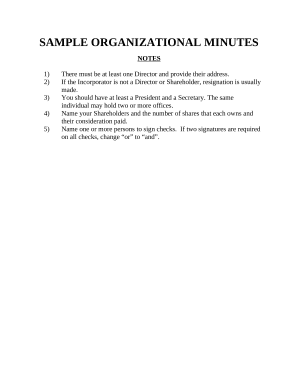

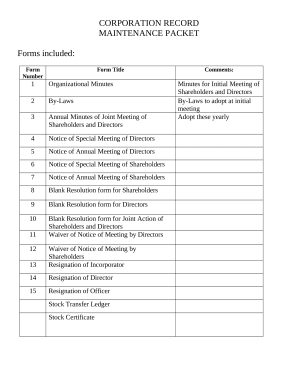

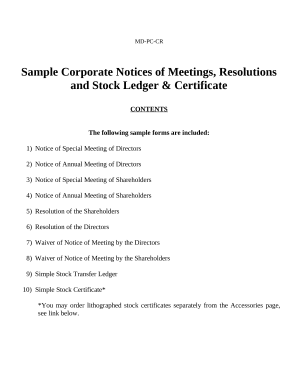

Speed up your file operations with our Corporate Record Keeping category with ready-made document templates that suit your requirements. Access the form, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the documents.

The best way to manage our Corporate Record Keeping:

Discover all the opportunities for your online file administration with the Corporate Record Keeping. Get your free free DocHub account right now!