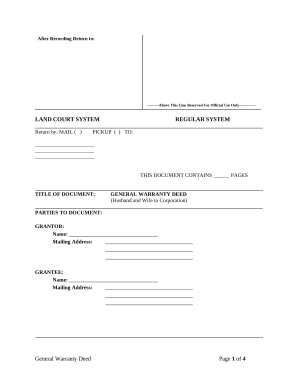

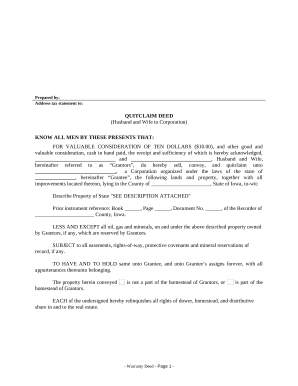

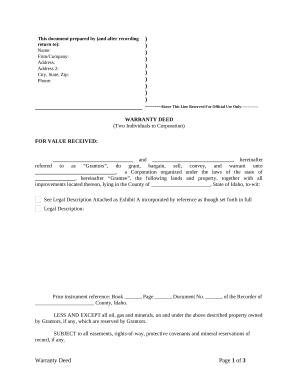

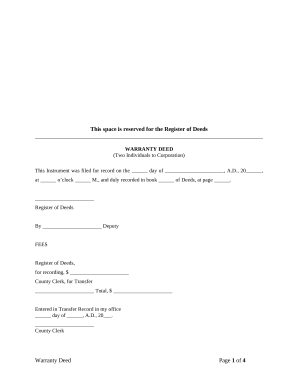

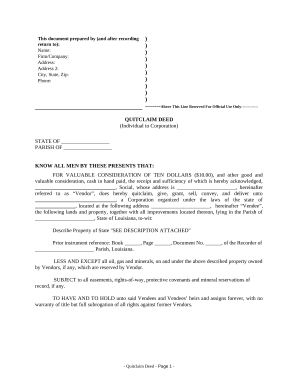

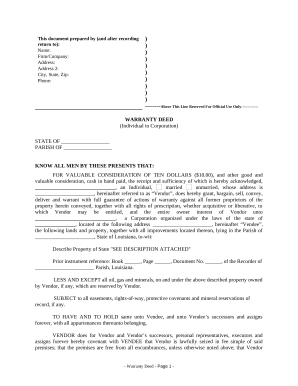

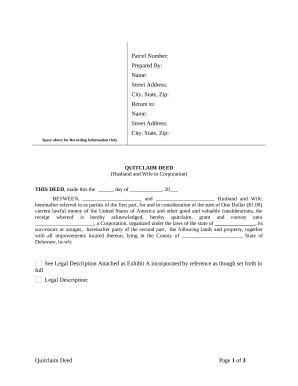

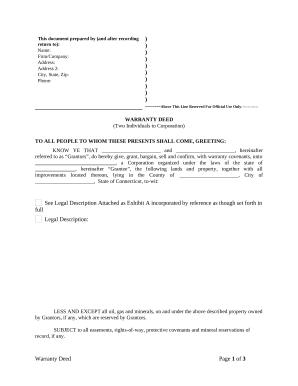

Accelerate your form managing using our Corporate Property Acquisition Forms library with ready-made form templates that suit your requirements. Get the document template, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your documents.

The best way to use our Corporate Property Acquisition Forms:

Explore all the opportunities for your online document administration using our Corporate Property Acquisition Forms. Get a totally free DocHub account today!