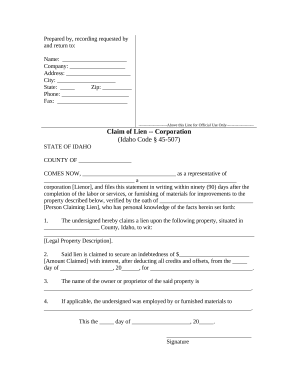

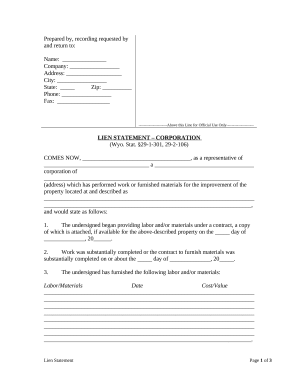

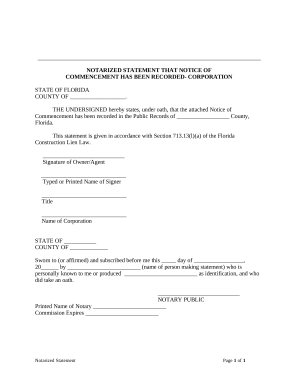

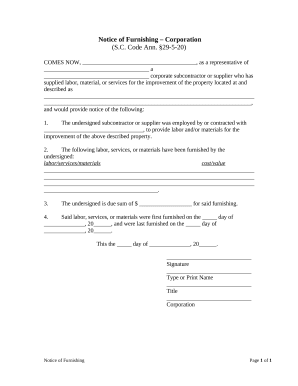

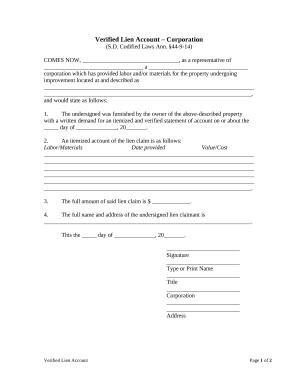

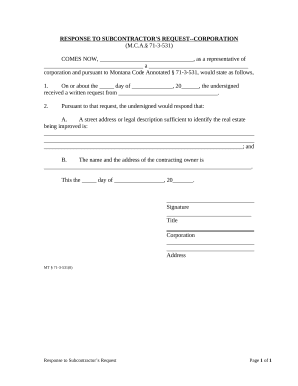

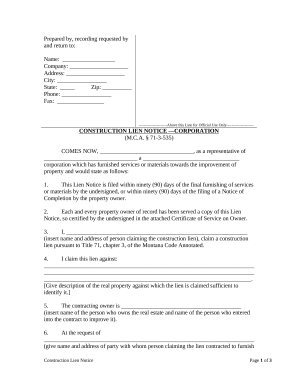

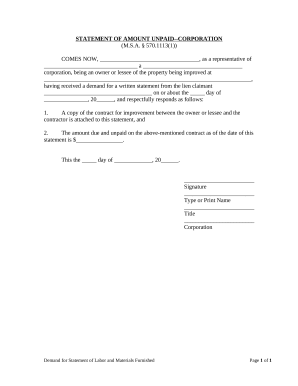

Supercharge your output with Corporate Lien Forms

Record management occupies to half of your office hours. With DocHub, you can reclaim your time and increase your team's efficiency. Access Corporate Lien Forms category and check out all templates related to your daily workflows.

Easily use Corporate Lien Forms:

- Open Corporate Lien Forms and use Preview to obtain the suitable form.

- Click on Get Form to begin working on it.

- Wait for your form to upload in our online editor and begin modifying it.

- Add new fillable fields, icons, and pictures, modify pages, and many more.

- Fill your template or prepare it for other contributors.

- Download or deliver the form by link, email attachment, or invite.

Accelerate your daily file management using our Corporate Lien Forms. Get your free DocHub account today to explore all templates.