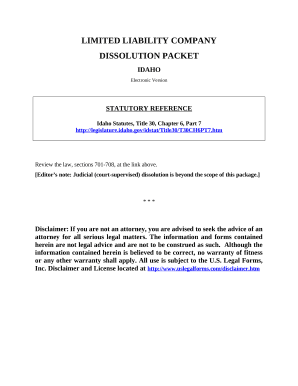

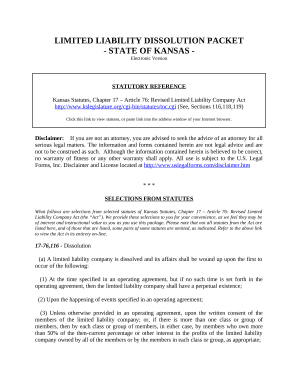

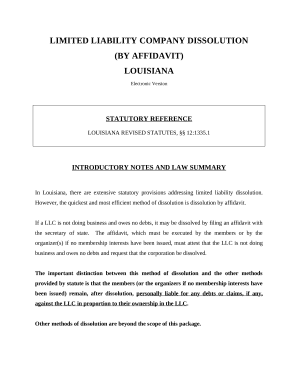

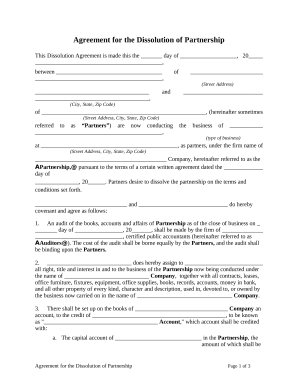

Your workflows always benefit when you can easily obtain all of the forms and files you may need on hand. DocHub gives a huge selection of templates to ease your daily pains. Get hold of Company Dissolution Forms category and easily discover your document.

Begin working with Company Dissolution Forms in several clicks:

Enjoy fast and easy document managing with DocHub. Explore our Company Dissolution Forms category and locate your form right now!