Boost your form operations using our California Business Legal Forms library with ready-made document templates that meet your requirements. Access the form template, alter it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively together with your documents.

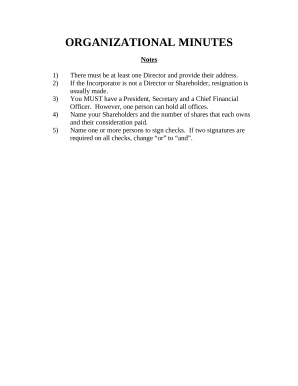

The best way to manage our California Business Legal Forms:

Explore all the opportunities for your online document management with the California Business Legal Forms. Get your free free DocHub profile right now!