Handle Business Sale Contracts effortlessly online

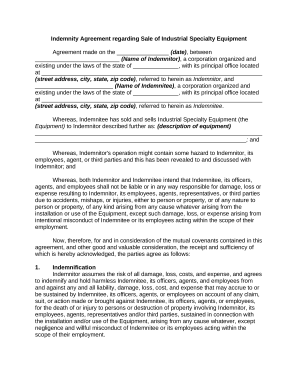

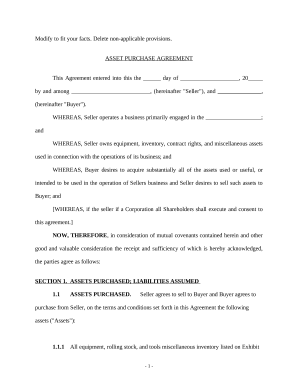

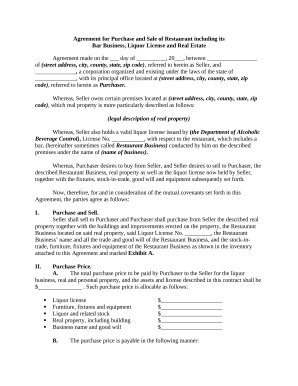

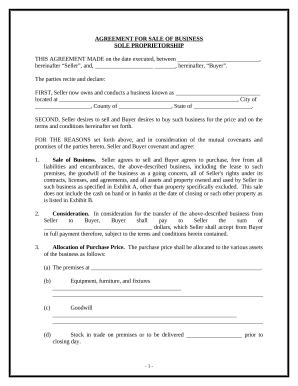

Document management can stress you when you can’t find all the documents you need. Luckily, with DocHub's considerable form library, you can get all you need and promptly deal with it without changing among software. Get our Business Sale Contracts and begin utilizing them.

How to use our Business Sale Contracts using these basic steps:

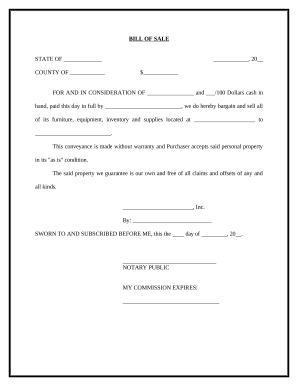

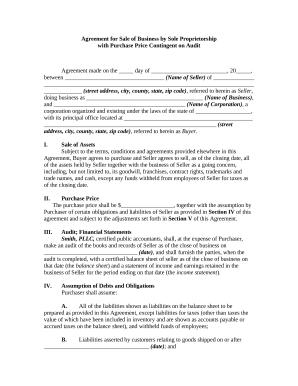

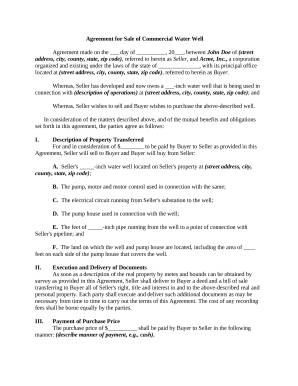

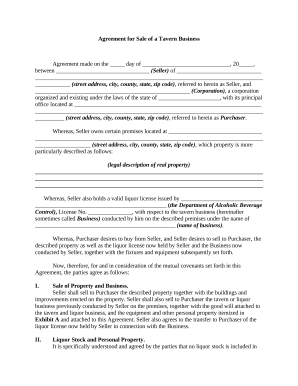

- Check Business Sale Contracts and choose the form you need.

- Preview the template and then click Get Form.

- Wait for it to upload in the online editor.

- Adjust your document: include new information and images, and fillable fields or blackout certain parts if necessary.

- Complete your document, conserve alterations, and prepare it for delivering.

- When ready, download your form or share it with other contributors.

Try out DocHub and browse our Business Sale Contracts category with ease. Get a free profile right now!