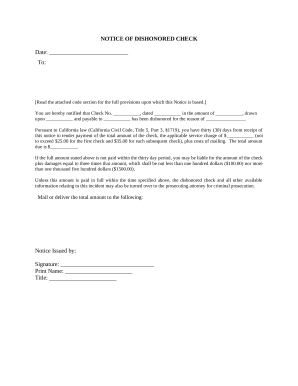

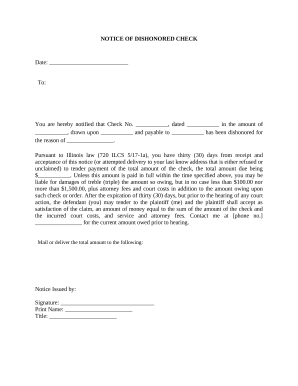

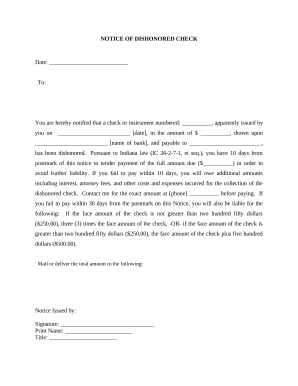

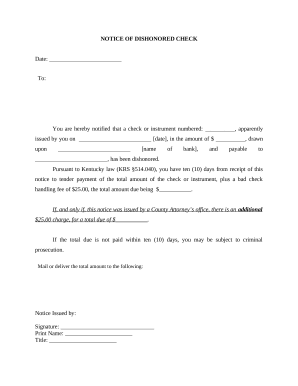

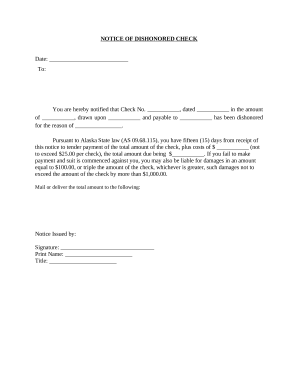

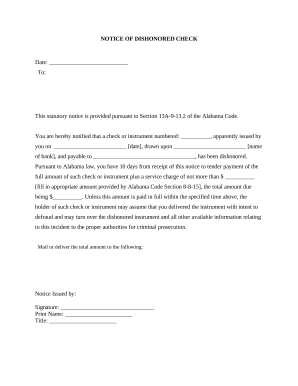

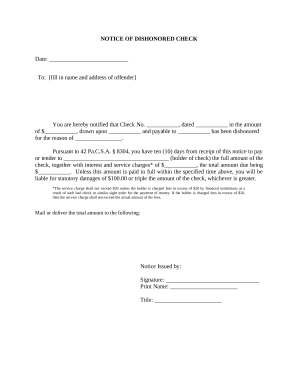

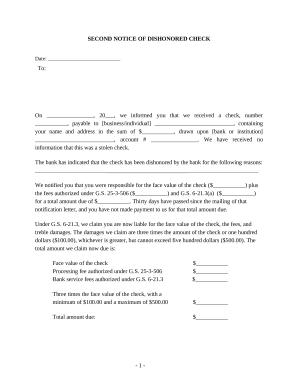

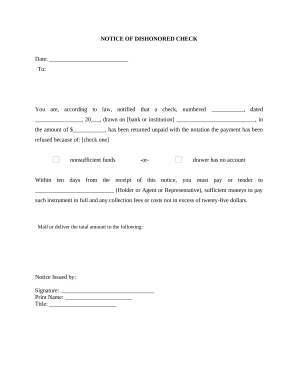

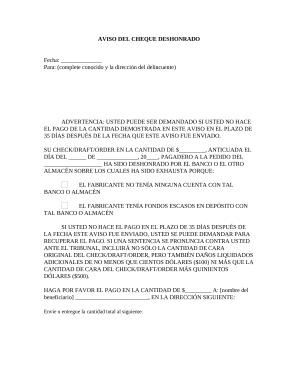

Speed up your document management with our Bounced Check Notices category with ready-made document templates that suit your needs. Access your document, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently together with your forms.

The best way to use our Bounced Check Notices:

Discover all the opportunities for your online file administration using our Bounced Check Notices. Get your totally free DocHub account right now!