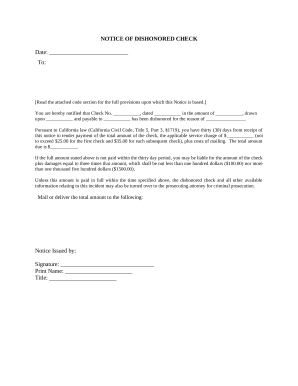

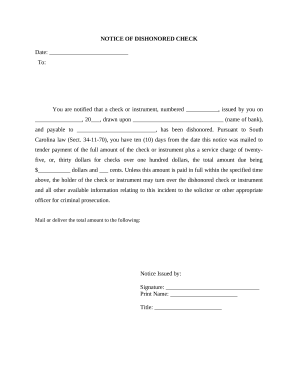

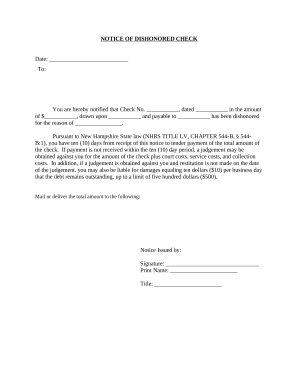

Accelerate your file management using our Bad Check Notice online library with ready-made templates that meet your requirements. Get the document, edit it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your documents.

The best way to use our Bad Check Notice:

Discover all the opportunities for your online document administration using our Bad Check Notice. Get your totally free DocHub account today!