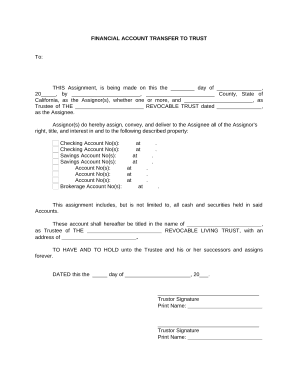

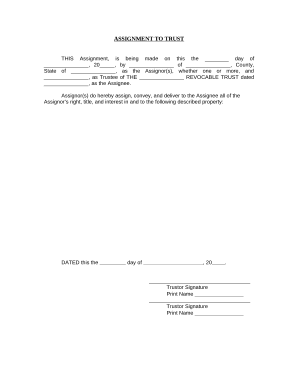

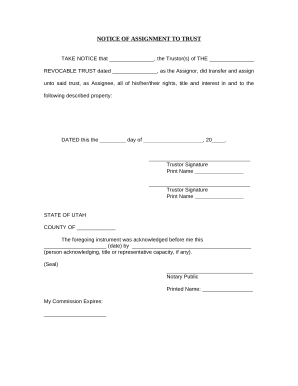

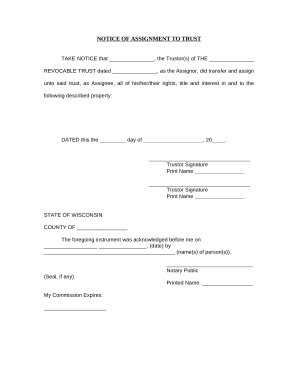

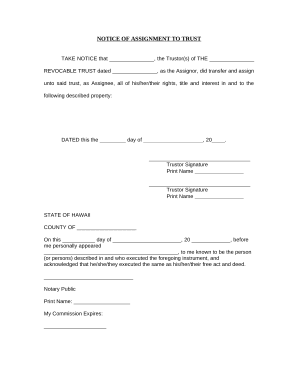

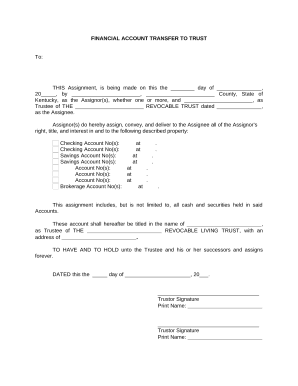

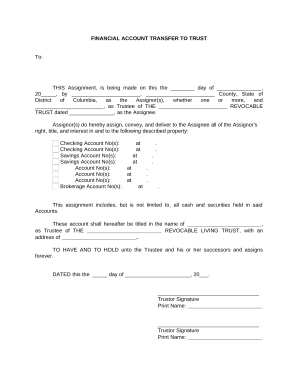

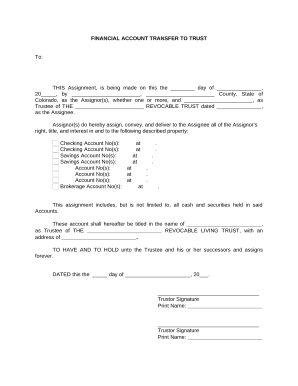

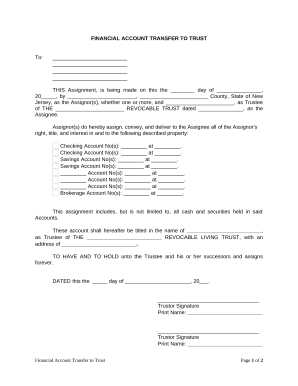

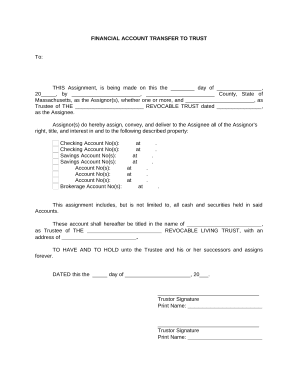

Speed up your document administration using our Asset Transfer to Living Trust category with ready-made form templates that meet your needs. Get the form, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively with your documents.

How to use our Asset Transfer to Living Trust:

Discover all the possibilities for your online document management with the Asset Transfer to Living Trust. Get a free free DocHub account today!