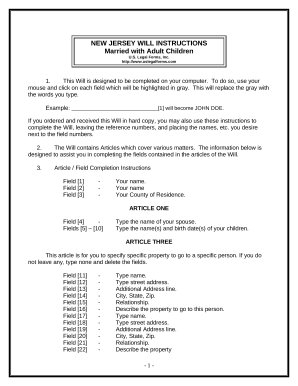

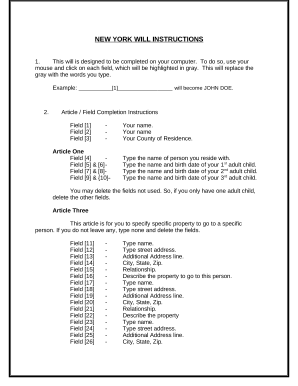

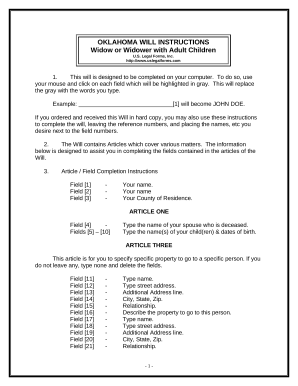

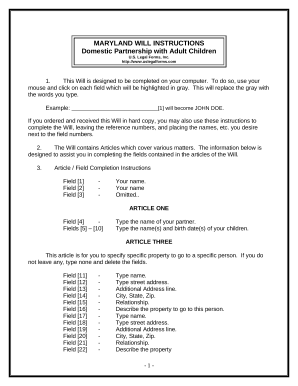

Boost your document management with the Adult Children Inheritance Forms online library with ready-made document templates that suit your needs. Access the document, alter it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

How to use our Adult Children Inheritance Forms:

Explore all of the opportunities for your online document management with the Adult Children Inheritance Forms. Get a free free DocHub account right now!