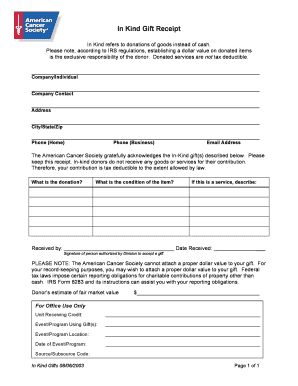

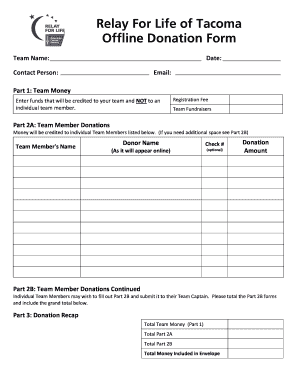

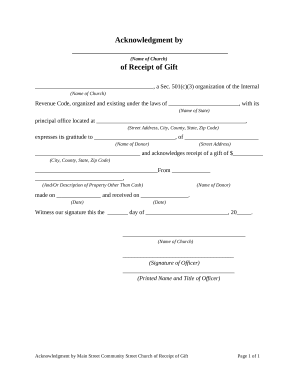

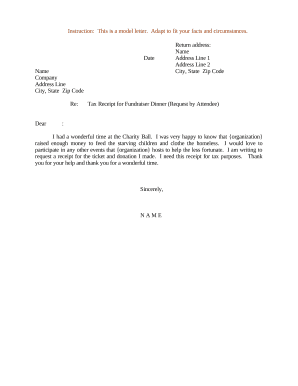

Simplify your fundraising workflows with DocHub's intuitive Year end receipt Donation Forms collection. Personalize and fill out documents swiftly and safely to facilitate donations easy for both you and your supporters.

Accelerate your file operations with our Year end receipt Donation Forms online library with ready-made document templates that meet your requirements. Access the form, alter it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with the documents.

The best way to use our Year end receipt Donation Forms:

Explore all of the possibilities for your online document management with our Year end receipt Donation Forms. Get your free free DocHub profile right now!