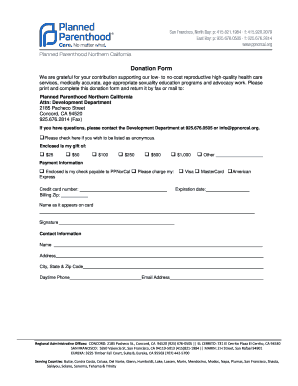

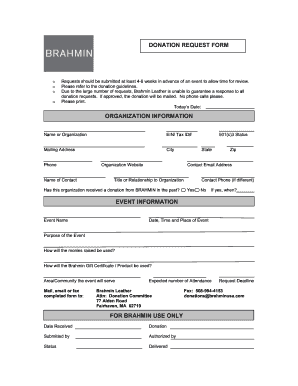

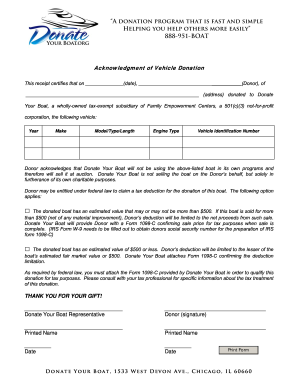

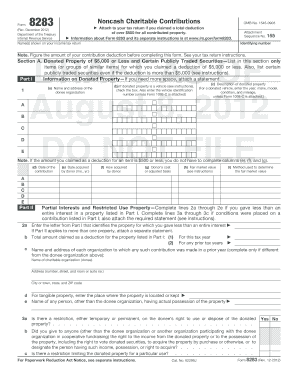

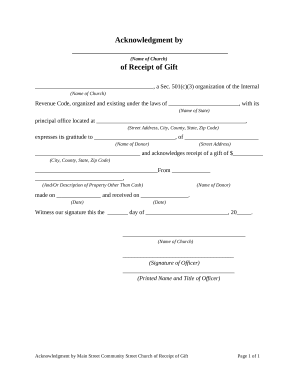

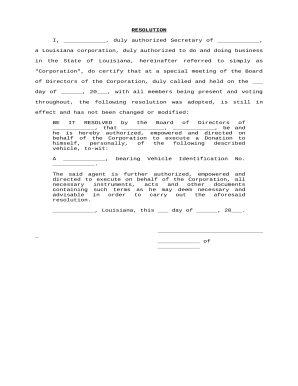

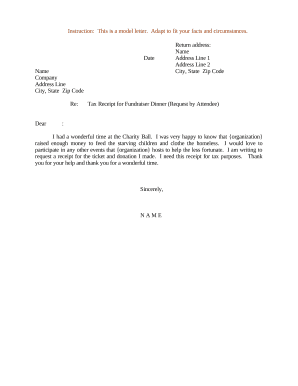

Improve your fundraising efforts with DocHub's modifiable Tax write off with receipt Donation Forms templates. Create a lasting impression on contributors with professional and customized donor templates.

Improve your form managing with our Tax write off with receipt Donation Forms online library with ready-made templates that meet your needs. Get your document, change it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your documents.

How to use our Tax write off with receipt Donation Forms:

Examine all the opportunities for your online file management with the Tax write off with receipt Donation Forms. Get a free free DocHub profile today!