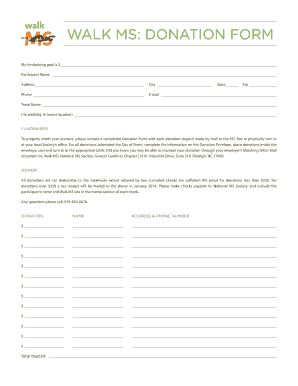

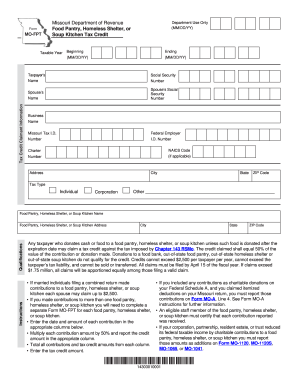

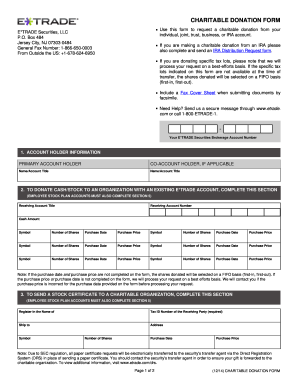

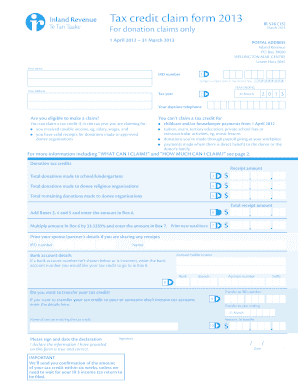

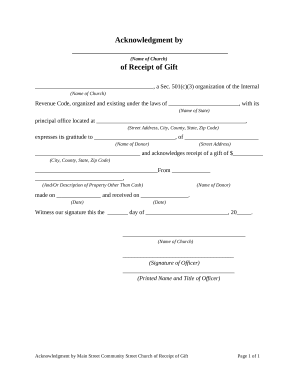

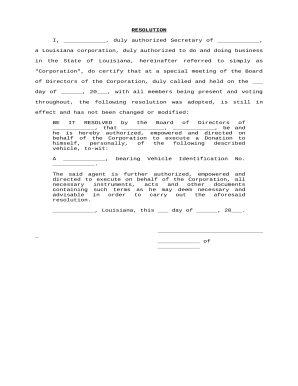

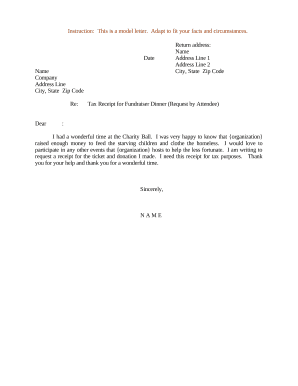

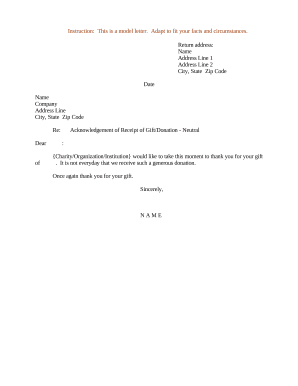

Select Tax write off Donation Forms and easily modify them online. Enhance your document handling workflows with DocHub.

Your workflows always benefit when you are able to obtain all the forms and documents you need at your fingertips. DocHub gives a wide array of documents to alleviate your day-to-day pains. Get hold of Tax write off Donation Forms category and easily discover your form.

Start working with Tax write off Donation Forms in several clicks:

Enjoy seamless form managing with DocHub. Check out our Tax write off Donation Forms online library and look for your form today!