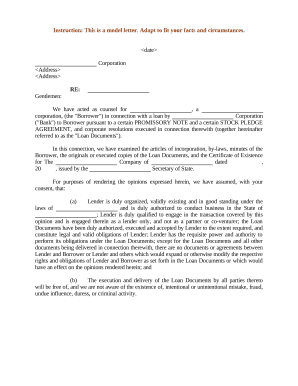

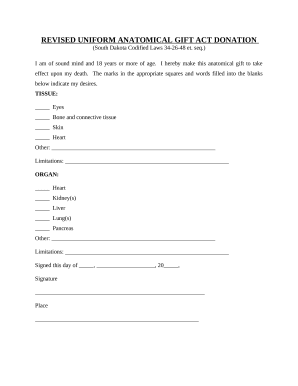

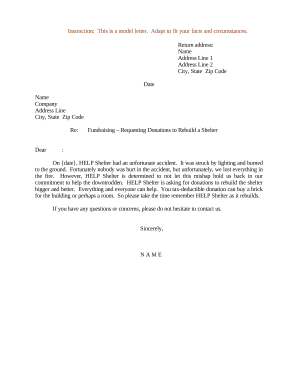

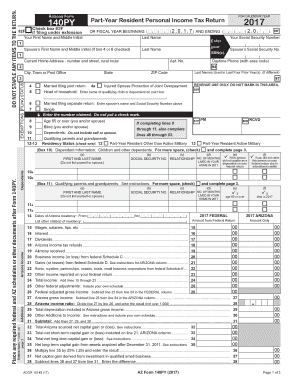

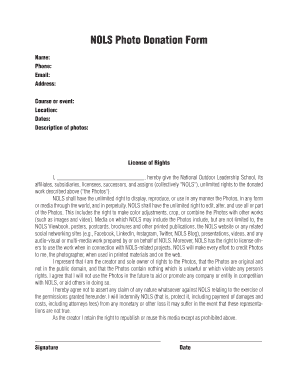

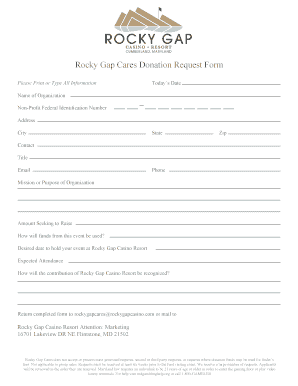

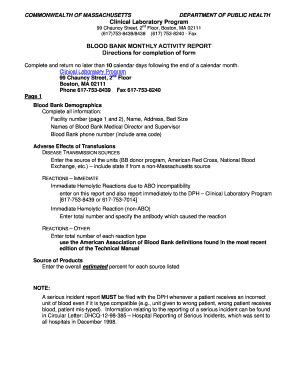

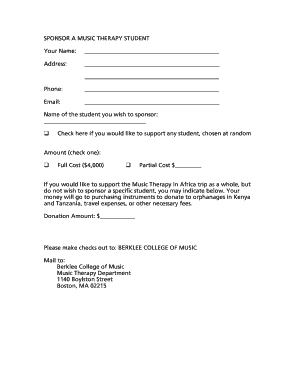

Obtain compliant and customizable Standard Donation Forms. Find and pick the documents relevant to your everyday document handling processes.

Your workflows always benefit when you can discover all the forms and documents you will need on hand. DocHub gives a huge selection of document templates to alleviate your day-to-day pains. Get a hold of Standard Donation Forms category and quickly find your form.

Begin working with Standard Donation Forms in a few clicks:

Enjoy smooth form management with DocHub. Check out our Standard Donation Forms collection and locate your form today!