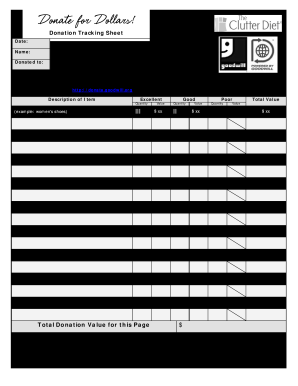

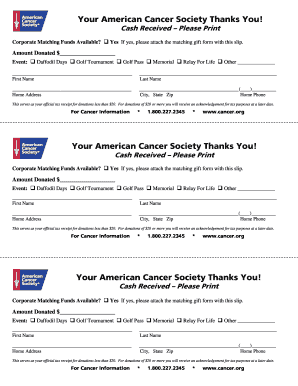

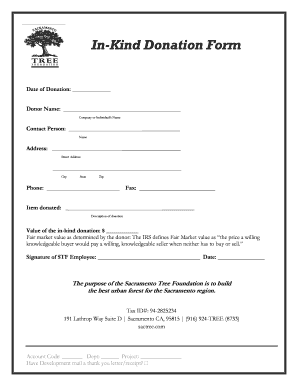

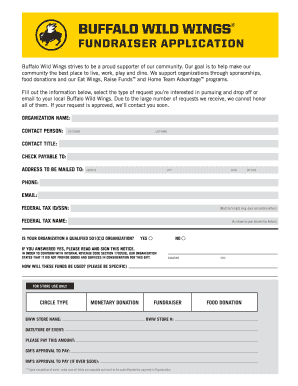

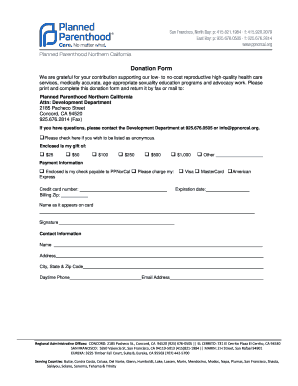

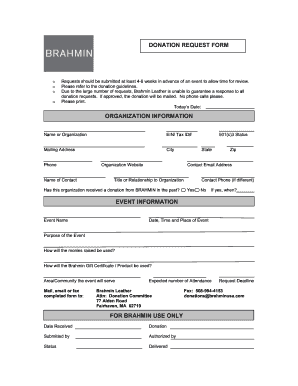

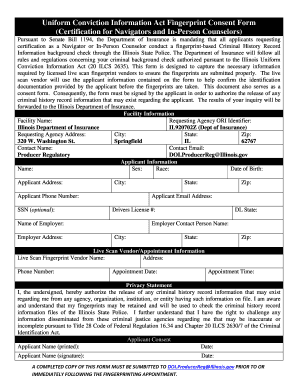

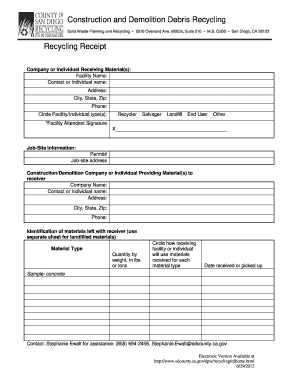

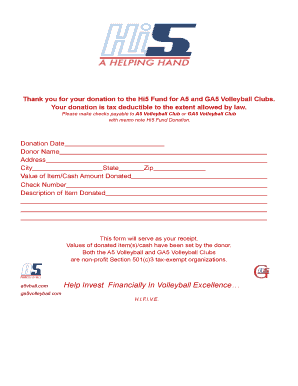

Enhance your fundraising workflows with DocHub's easy-to-use Simple receipt Donation Forms catalog. Customize and fill out documents quickly and safely to ease donating a breeze for both you and your contributors.

Papers managing consumes to half of your business hours. With DocHub, it is easy to reclaim your time and improve your team's efficiency. Get Simple receipt Donation Forms collection and explore all form templates relevant to your daily workflows.

The best way to use Simple receipt Donation Forms:

Speed up your daily document managing using our Simple receipt Donation Forms. Get your free DocHub profile right now to explore all forms.