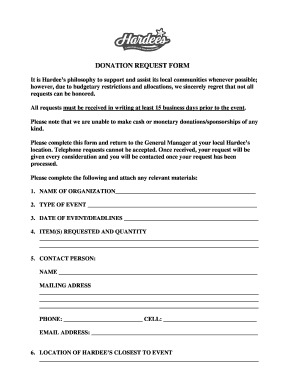

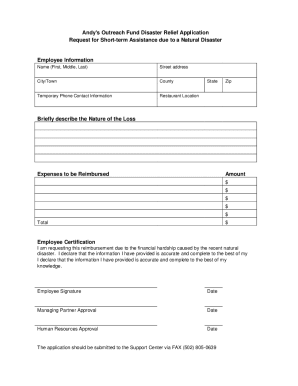

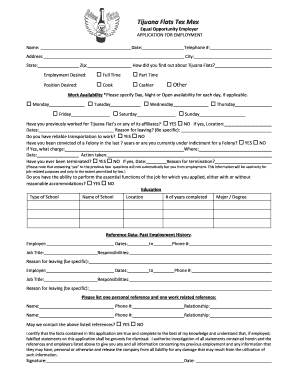

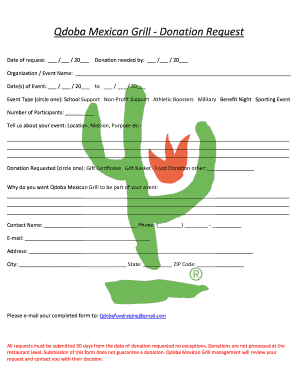

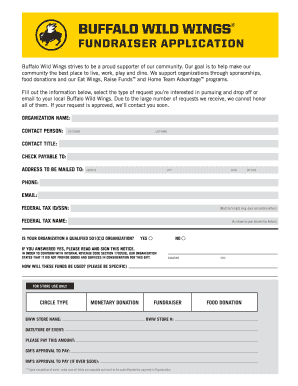

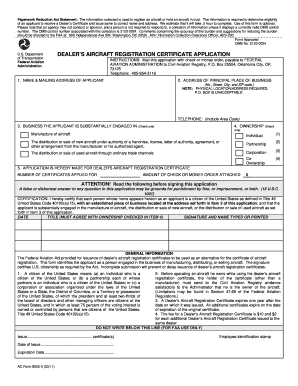

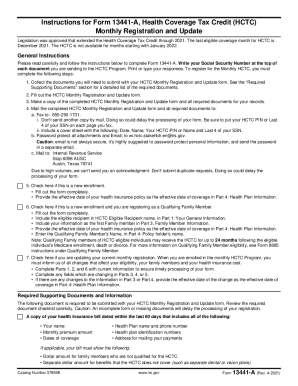

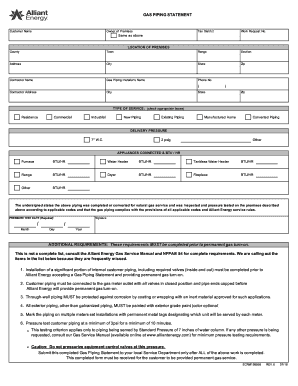

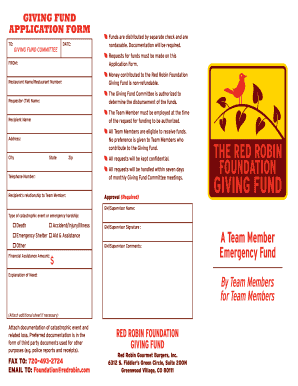

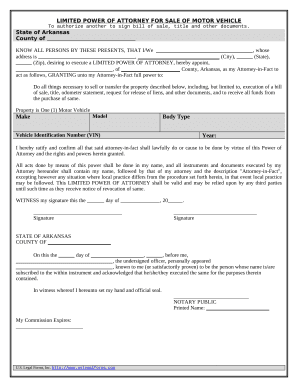

Access compliant and modifiable Restaurant certificate Donation Forms. Find and select the forms appropriate to your everyday document handling workflows.

Your workflows always benefit when you can discover all the forms and documents you may need at your fingertips. DocHub offers a huge selection of document templates to alleviate your everyday pains. Get hold of Restaurant certificate Donation Forms category and easily discover your form.

Start working with Restaurant certificate Donation Forms in several clicks:

Enjoy effortless record administration with DocHub. Explore our Restaurant certificate Donation Forms collection and locate your form today!