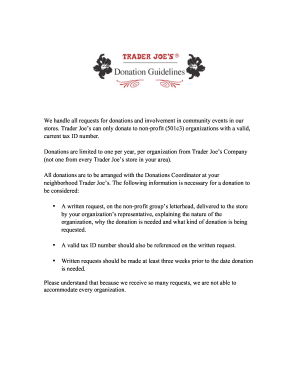

Discover Recipe Donation Forms and simplify their handling with DocHub's powerful editing tools. Manage, distribute, and securely save your documents without breaking a sweat.

Your workflows always benefit when you can find all of the forms and documents you need at your fingertips. DocHub gives a vast array of templates to ease your day-to-day pains. Get hold of Recipe Donation Forms category and easily discover your form.

Begin working with Recipe Donation Forms in a few clicks:

Enjoy easy record administration with DocHub. Explore our Recipe Donation Forms online library and locate your form today!