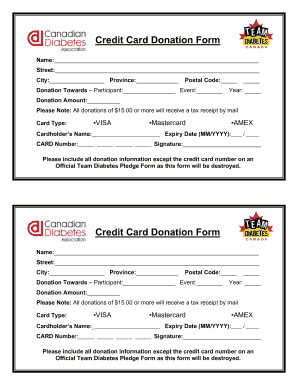

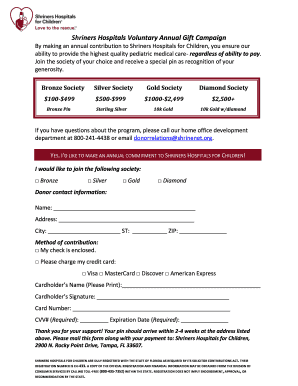

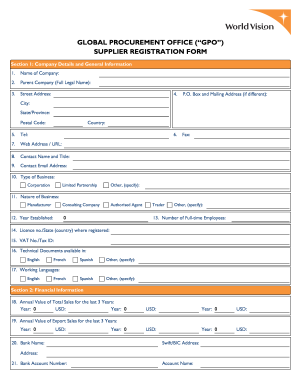

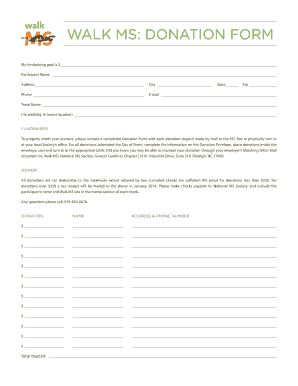

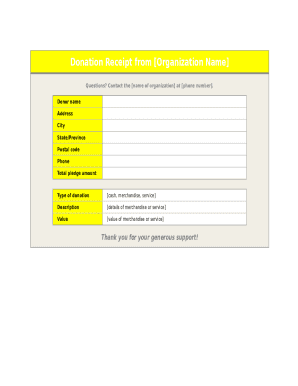

Take the hassle out of donation forms with DocHub's online Receipt canada Donation Forms collection. Easily edit, complete, and securely send forms with your donors.

Your workflows always benefit when you are able to locate all the forms and files you may need at your fingertips. DocHub supplies a wide array of document templates to alleviate your everyday pains. Get a hold of Receipt canada Donation Forms category and quickly browse for your form.

Begin working with Receipt canada Donation Forms in a few clicks:

Enjoy effortless document administration with DocHub. Check out our Receipt canada Donation Forms collection and find your form today!