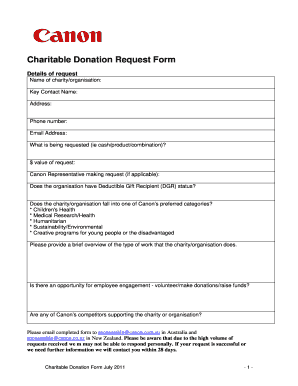

Browse Receipt australia Donation Forms and easily discover relevant documents. Simplify and boost the document organization procedures for your organization.

Your workflows always benefit when you can locate all the forms and documents you require at your fingertips. DocHub offers a vast array of templates to alleviate your day-to-day pains. Get hold of Receipt australia Donation Forms category and easily discover your document.

Start working with Receipt australia Donation Forms in a few clicks:

Enjoy easy document management with DocHub. Discover our Receipt australia Donation Forms collection and locate your form right now!