Explore Receipt and thank you Donation Forms and enhance their organization with DocHub's powerful editing tools. Manage, distribute, and safely store your documents without breaking a sweat.

Form administration takes up to half of your office hours. With DocHub, it is simple to reclaim your office time and enhance your team's productivity. Get Receipt and thank you Donation Forms collection and explore all form templates relevant to your everyday workflows.

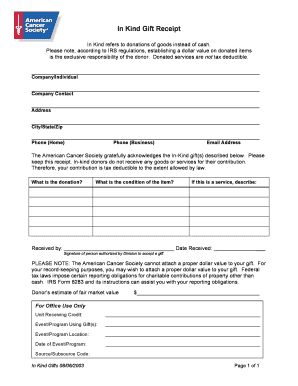

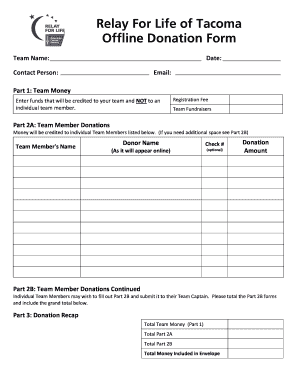

Easily use Receipt and thank you Donation Forms:

Improve your everyday document administration with our Receipt and thank you Donation Forms. Get your free DocHub account today to explore all forms.