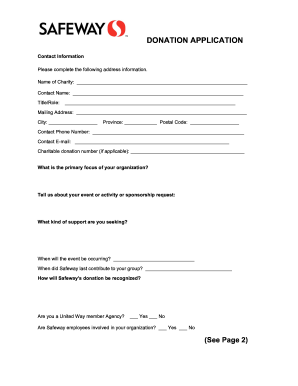

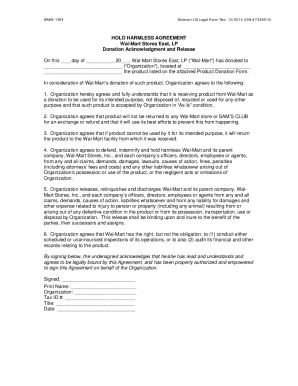

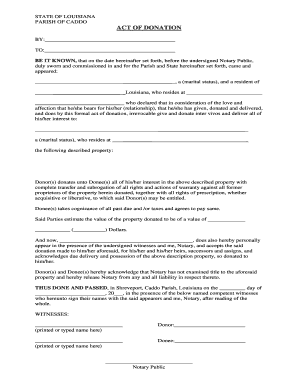

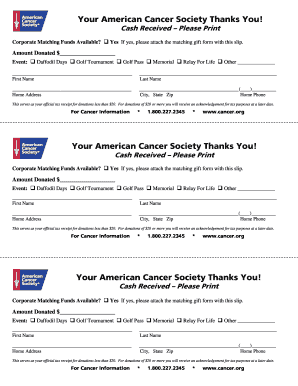

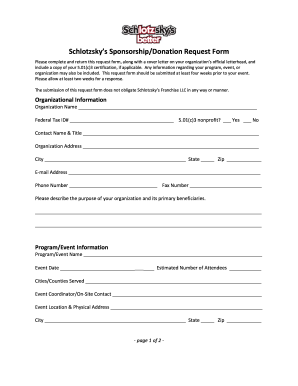

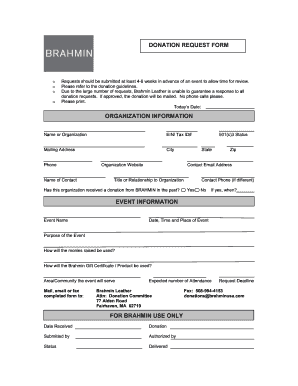

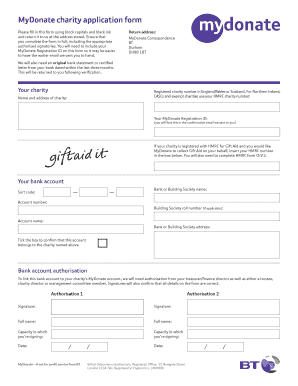

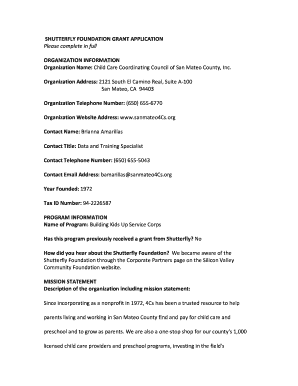

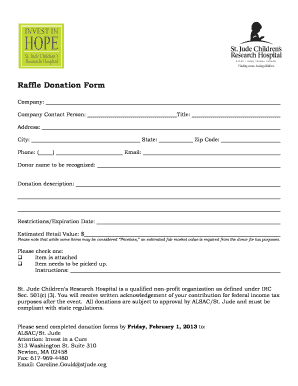

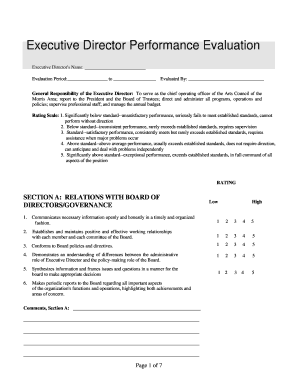

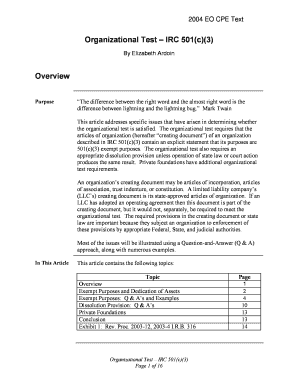

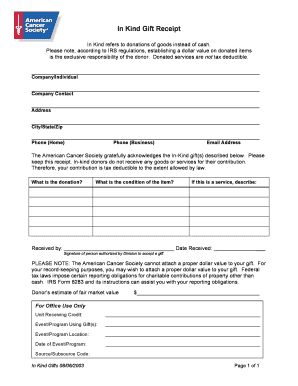

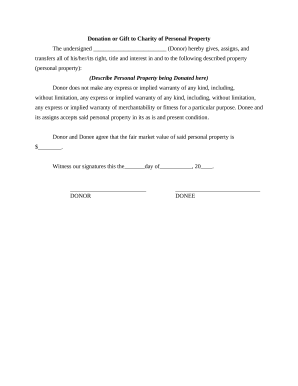

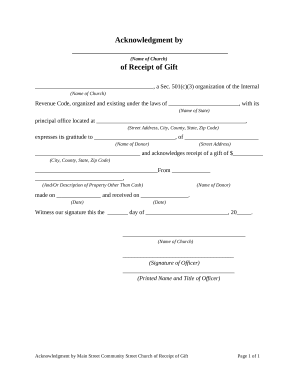

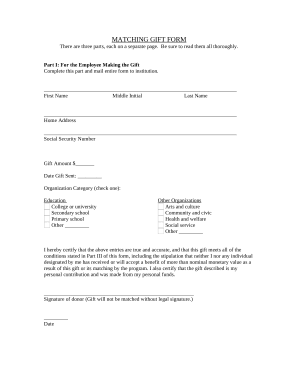

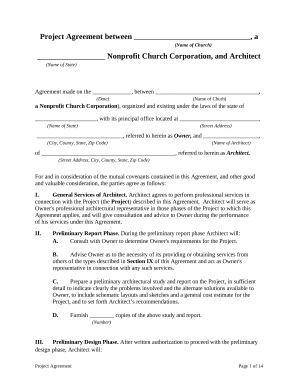

Monitor all your donations easily with Nonprofit tax purposes Donation Forms collection. Get them anytime, wherever you are, and never miss important donation information again.

Papers management occupies to half of your office hours. With DocHub, it is easy to reclaim your time and effort and enhance your team's efficiency. Access Nonprofit tax purposes Donation Forms online library and investigate all document templates related to your everyday workflows.

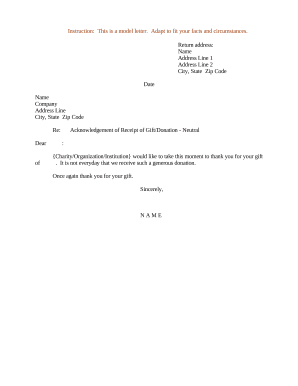

Easily use Nonprofit tax purposes Donation Forms:

Boost your everyday file management using our Nonprofit tax purposes Donation Forms. Get your free DocHub account right now to discover all templates.