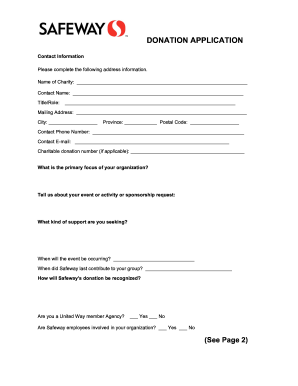

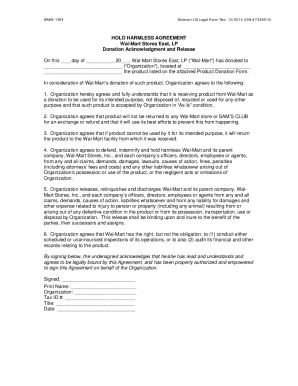

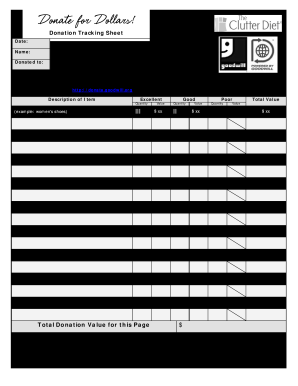

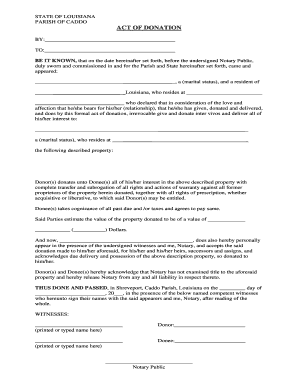

Enhance your fundraising efforts with DocHub's customizable Nonprofit return policy Donation Forms templates. Make a lasting impression on contributors with professional and customized fundraising documents.

Speed up your form operations using our Nonprofit return policy Donation Forms category with ready-made form templates that suit your requirements. Access your document, edit it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently with the forms.

The best way to manage our Nonprofit return policy Donation Forms:

Discover all the opportunities for your online document management with our Nonprofit return policy Donation Forms. Get your free free DocHub profile right now!