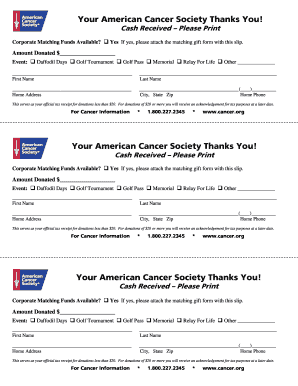

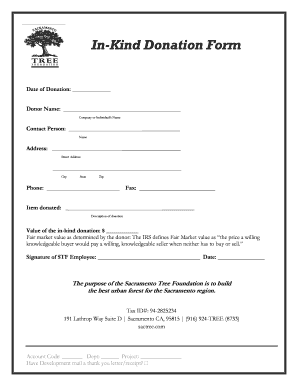

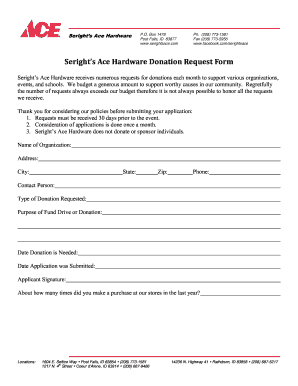

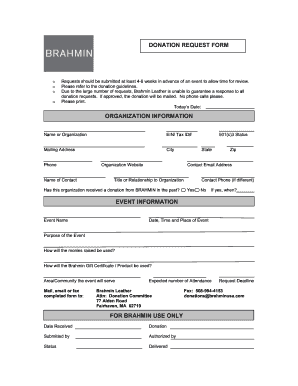

Discover Non profit no goods or services Donation Forms collection and choose the relevant document for your organization. Facilitate open and clear communication between you and your supporters.

Your workflows always benefit when you can obtain all the forms and documents you need on hand. DocHub delivers a wide array of templates to relieve your daily pains. Get hold of Non profit no goods or services Donation Forms category and easily discover your form.

Begin working with Non profit no goods or services Donation Forms in several clicks:

Enjoy easy document managing with DocHub. Explore our Non profit no goods or services Donation Forms category and find your form today!